- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

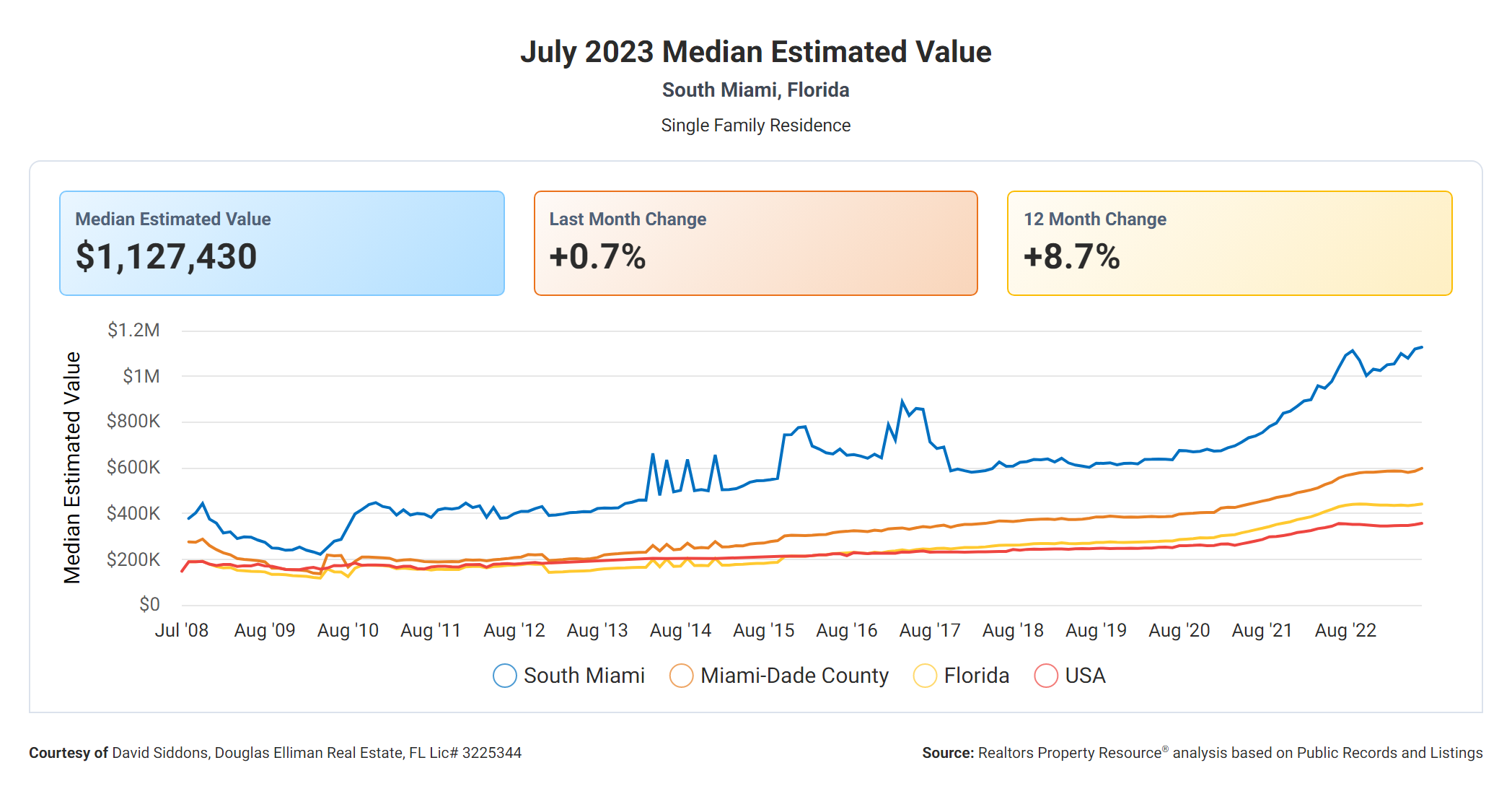

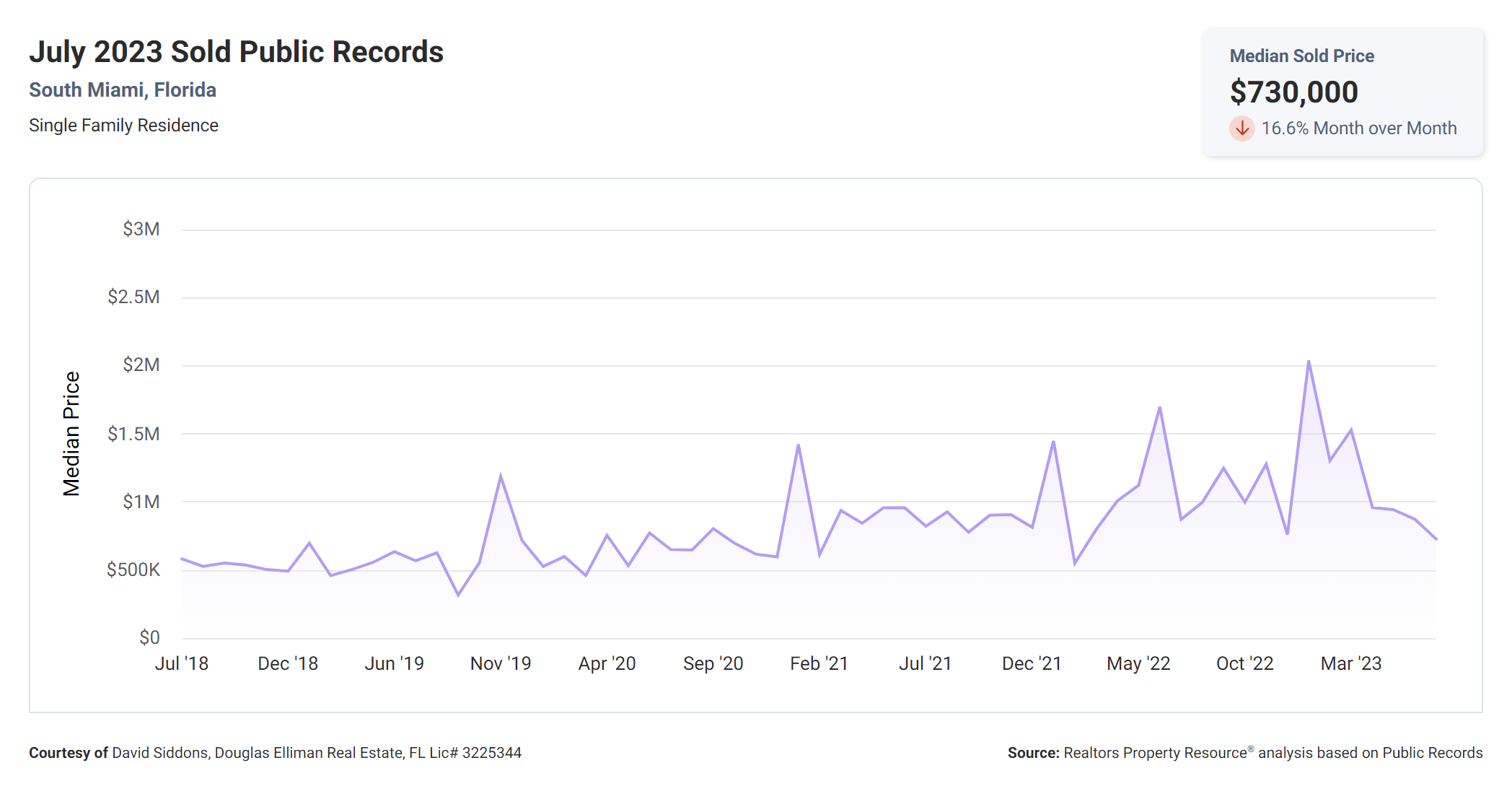

South Miami Is Still Climbing! | South Miami Q1 & Q2 2023 Market Summary

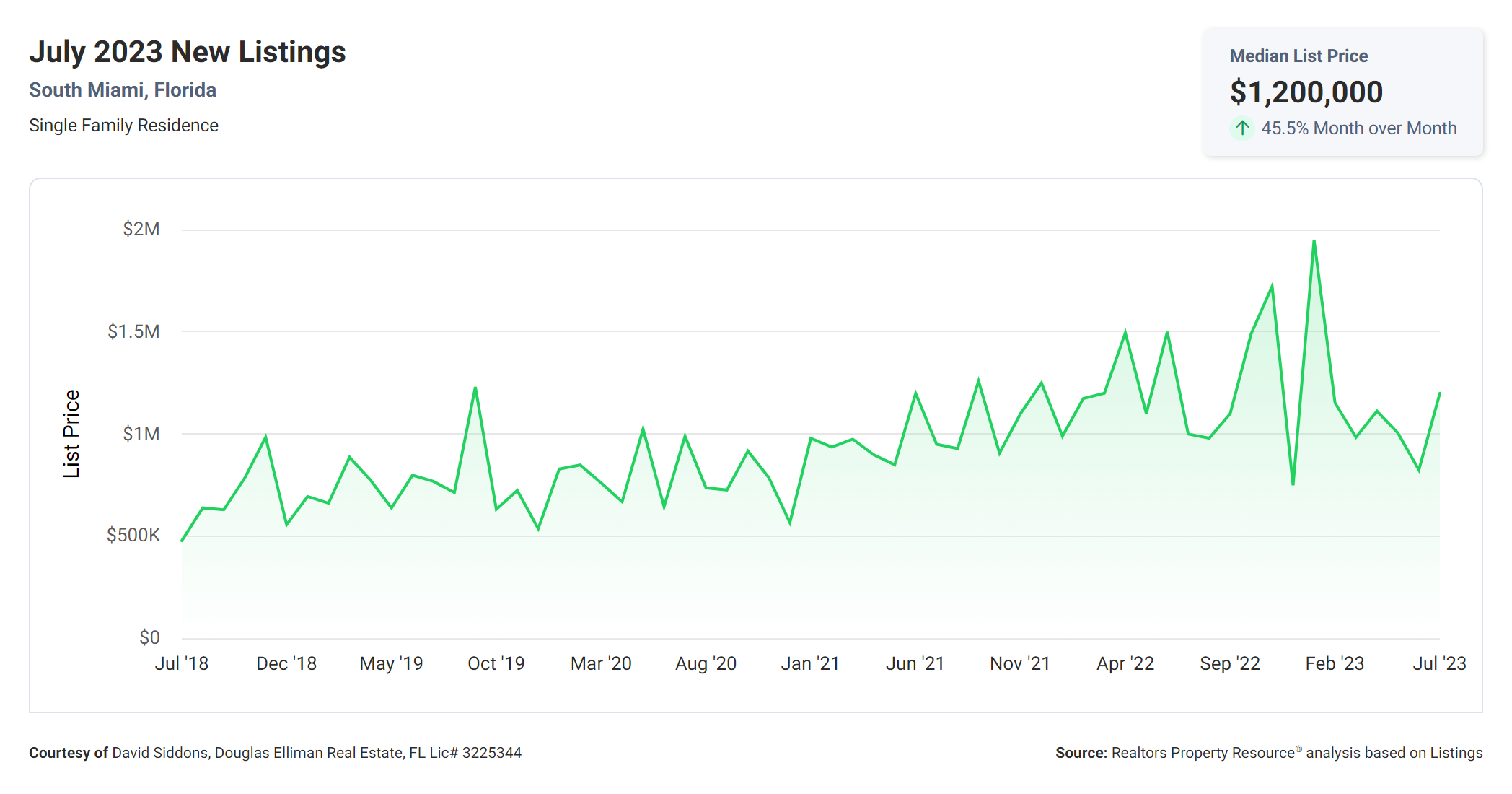

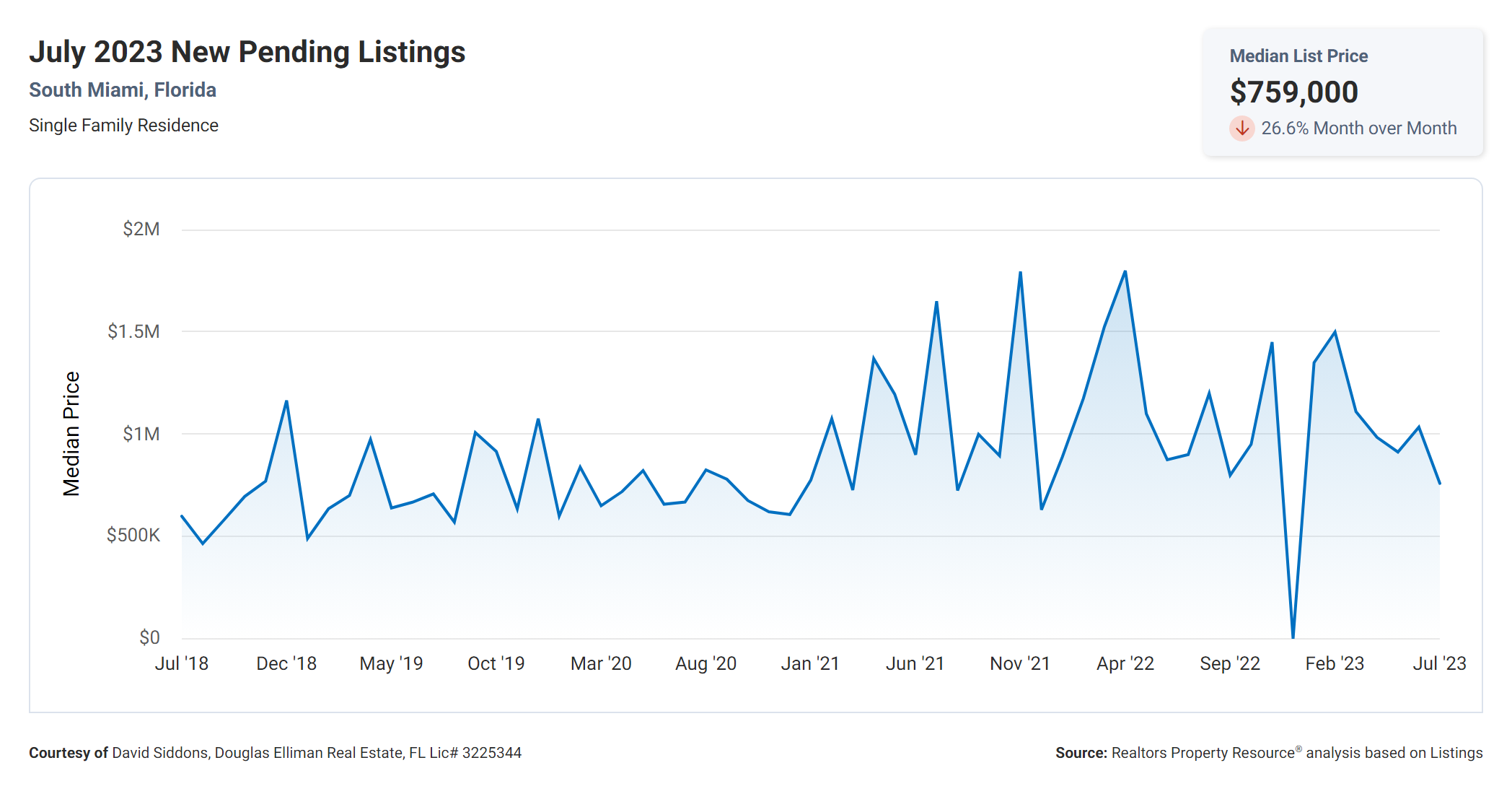

South Miami Q1 & Q2 2023 Market Summary. So half of 2023 has officially flown by and here’s how I see the market today. Firstly, we still remain at record lows for inventory in South Miami. Inventory is around 2 months so we are still ways away from a balanced market where you would typically find inventory anywhere from 6-8 months. We are now seeing all of the new construction products entering the market above $1,000 per SF with highs in the $1,200/1,300 per SF range which is a new standard. However, the majority of the inventory which is not new construction is trading in the 700-900 $ per SF range depending on location and specifics of the home. So we are seeing prices still going up but the volume of trading is a bit down due to interest rates.

We are seeing homes that are not new construction but are so well located that they are easily selling above the 1,000 per SF mark. Areas like High Pines, pockets east of US1 by Dante Fascell Park and 80th Street. These pockets are experiencing massive upswings in price and are now comparable in price to the major markets that are a bit more well-known to outside investors like Coral Gables and Coconut Grove.

South Miami is also seeing a boom west of US1 as land is a bit less expensive. So the major price increases east of US1 have inadvertently caused this shift of focus to the west part of US1. Many of these homes are not for sale or they have not sold yet but this side of the South Miami neighborhood is improving at an insane pace. Neighborhoods down the Sunset corridor that are close to the much appreciated and coveted “downtown” of South Miami may have washed away much of the historical anti of “west of US1” as we are seeing many high-level custom homes being built off Sunset Dr. on the west side of the Highway.

Advice for Buyers

No home is perfect but if you get an opportunity for something in High Pines or the pockets off 57th Ave strike fast. These homes will continue to rise and you can add on and or improve with time and gain equity perhaps even tear down and build at a later date as the location is A+. If you are a builder I would consider looking down the Sunset corridor and in the pockets west of US1 as land is getting way too expensive in High Pines/ 57th Ave – Consider looking just 10 just blocks west for a better buy and these areas still have much to appreciate.

South Miami is the best area in all of Miami that you can still buy into around 1m but don’t wait for long Somi is climbing!

- In the 3-5m you have more options in this area for newer construction and things tend to open up a bit more in comparison to other areas like Coconut Grove and Coral Gables where newer homes in this price range is hard to come by.

- In the $5m+ Range, several stunning homes in the area will not disappoint. Consider South Miami as a closer and more accessible Pinecrest – where there are already homes selling above 10m so why not South Miami?

Advice for Sellers

If you are a Seller in this area you most likely already know what’s been happening. I would just say that yes, things have slowed down a bit – which is what everyone likes to say however it is still a very strong market. Most Sellers today don’t want to trade in their sub 3% mortgages however if you can get a high enough price it may still be worth it. As we go into the more active selling season of the year I would expect the market to continue to pick up from the slower summer months. Being an owner/ seller today in this market is still a great place to be. As always call us to discuss your home and let’s get a conversation going. We are the Somi experts. We love it and we live it.

Read our other neighborhood and luxury reports

If you would like to get perspective on other specific neighborhoods or luxury reports. Please click here to go to our main database of reports. We update these every 6 months.

Schedule Time with David and Jorge

FAQ

These are the most commonly asked Google Real Estate Related questions

I see the market is a sellers market, what does that mean?

A sellers market is a market in which there is more demand than supply. Therefore sellers have an advantage. A balanced market is a market in which neither buyers nor sellers have an advantage.

Do you think we should wait for interest rates to go down before buying a home?

Many buyers are waiting for rates to come down. If the rates will come down, many buyers will become active again or current owners might look for alternatives. This will create market activity again, which has been slow in the last few months.

For people that are waiting for interest rates to come down, we have some advice. By the time rates go down, prices will go up again. If you want to buy a home anywhere in the next year, buy it now and refinance later. If interest rates don’t come down it’s because inflation is still high and that’s mostly a consequence of a hot housing market so this also means housing prices will continue to go up. So in almost all scenarios, you are losing by waiting for interest rates to go down.

Do you think home prices will come down any time soon?

The nation, and Miami, is experiencing a severe housing shortage we need to address, especially when it comes to single-family houses. We see many new condos being construction, but most of Miami’s new condos are in the $2,000 per SF + range, so this caters only to a small group of buyers.

We are still in the expansion phase and given we are not building sufficient housing units to cover the 4 million in shortage, we do not expect to enter the hyper-supply phase any time soon.

In addition, everyone is waiting for the crash. There is so much money waiting for when the market goes down that almost by definition the market will not crash. If prices will come down by 10% many people will start buying. There is a lot of money waiting to get into this market, in combination with a shortage of properties. As a result, a strong correction is highly unlikely.

For more information please listen to our latest podcast in which we discuss the likelihood of the market to crash with a FIU professor of Real Estate: https://luxlifemiamiblog.com/is-a-miami-real-estate-crash-coming-the-economic-truth-with-fiu-professor-eli-beracha/

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS