- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Sellers Becoming Increasingly Realistic as Inventory Levels Rise | Miami Beach Q1 & Q2 2023 Market Summary

Q1 & Q2 2023 Miami Beach Market Summary | Single-Family Homes

Miami Beach Q1 & Q2 2023 Market Summary

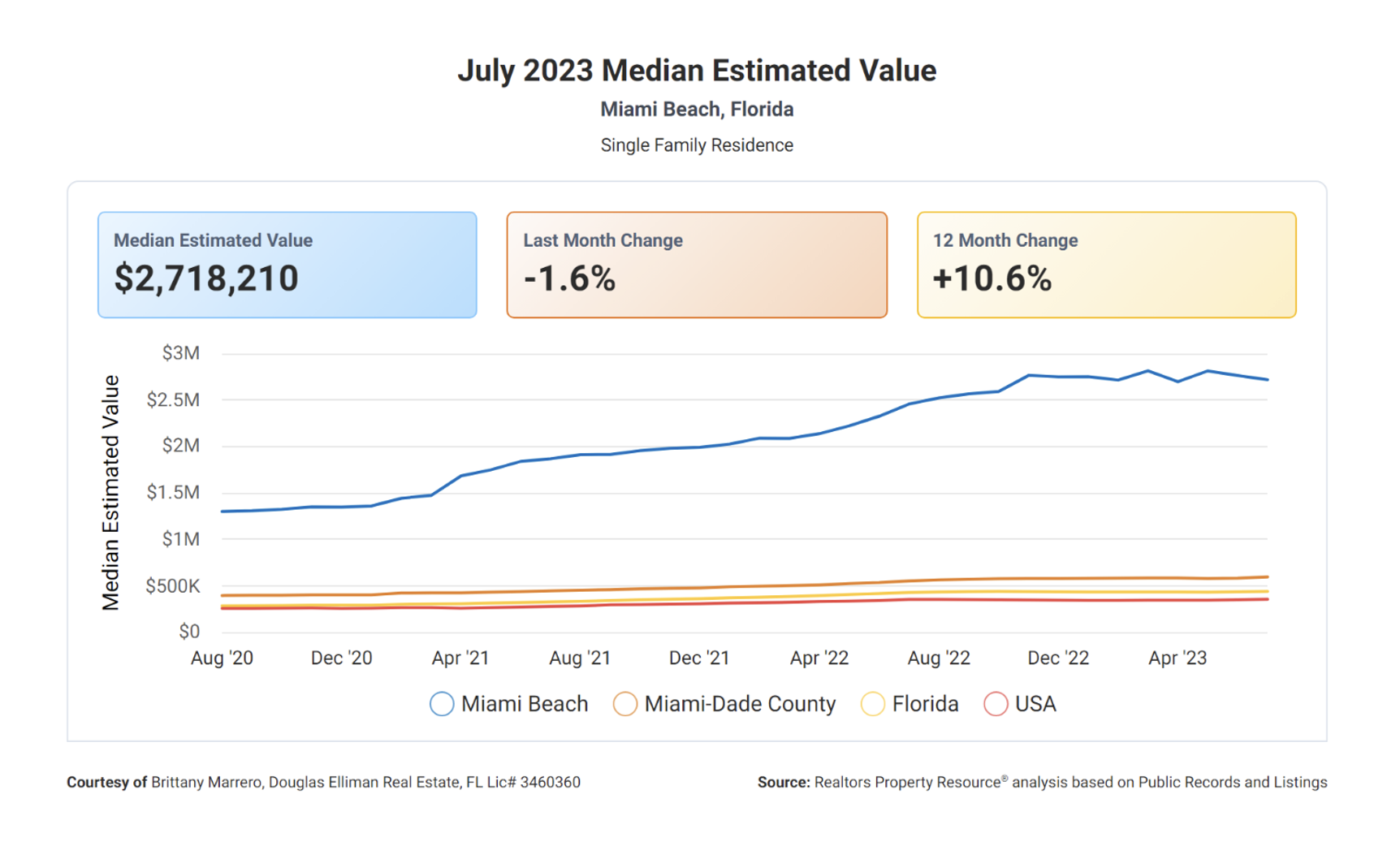

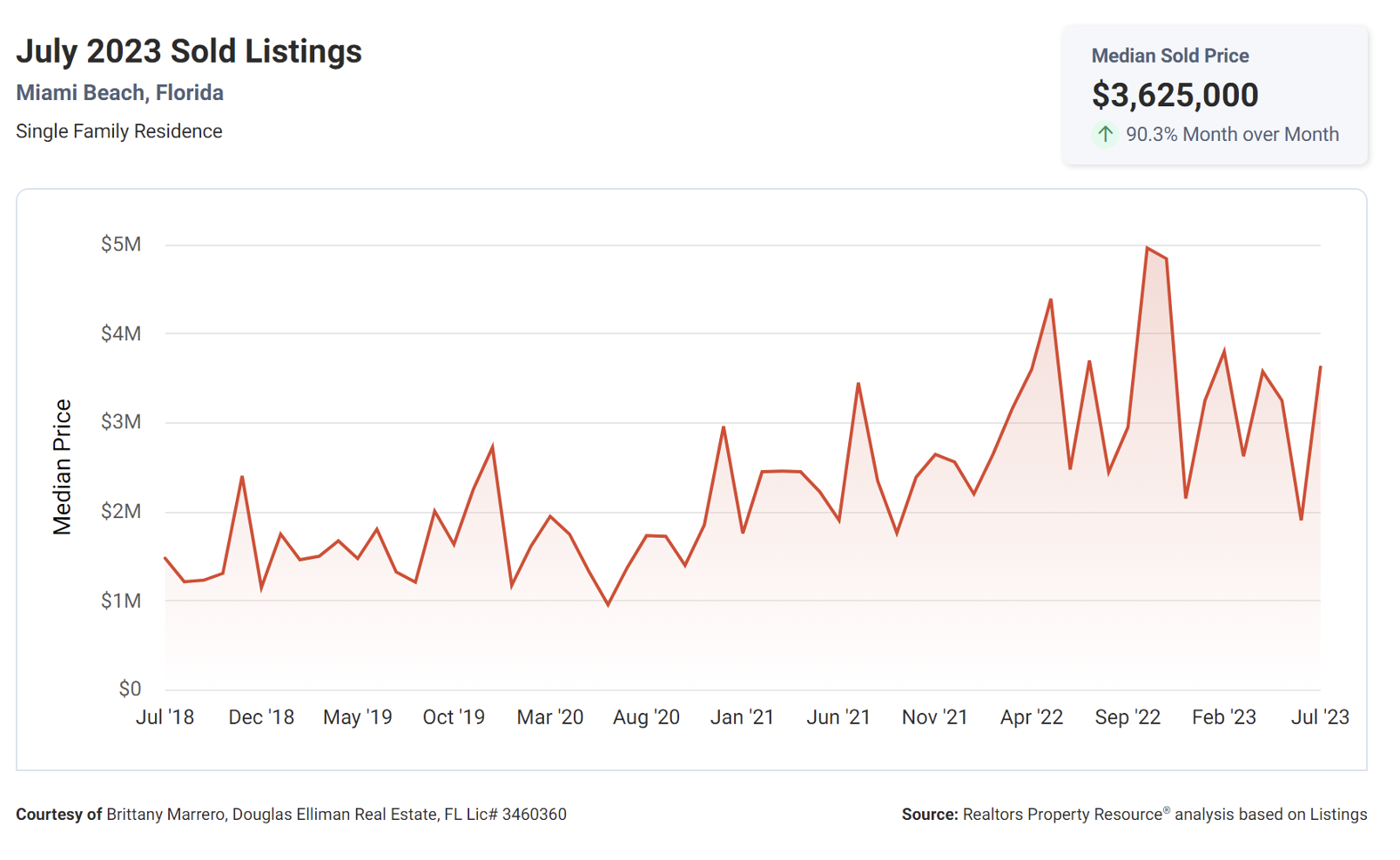

The Miami Beach Family Home market is a tricky market that experts are trying to grasp as best as they can. Signs point towards a market that should be cooling however some sectors of the market continue to see record-breaking prices.

For example, the luxury sector average sales price is up 11.6% from Q2-2022 despite the following factors:

- The number of sales is down just over 50%

- Up to 33 months of supply (balance market 6-9 months)

- Listing discounts at 15%

The overall single-family home market in Miami Beach is seeing more regular behavior. The average sales price is down 22% from Q2-2022 and this falls in line with other supporting factors we are seeing in the market. Some of the factors include a lower volume of overall sales, an increase in inventory and monthly supply, and larger discounts on the asking price.

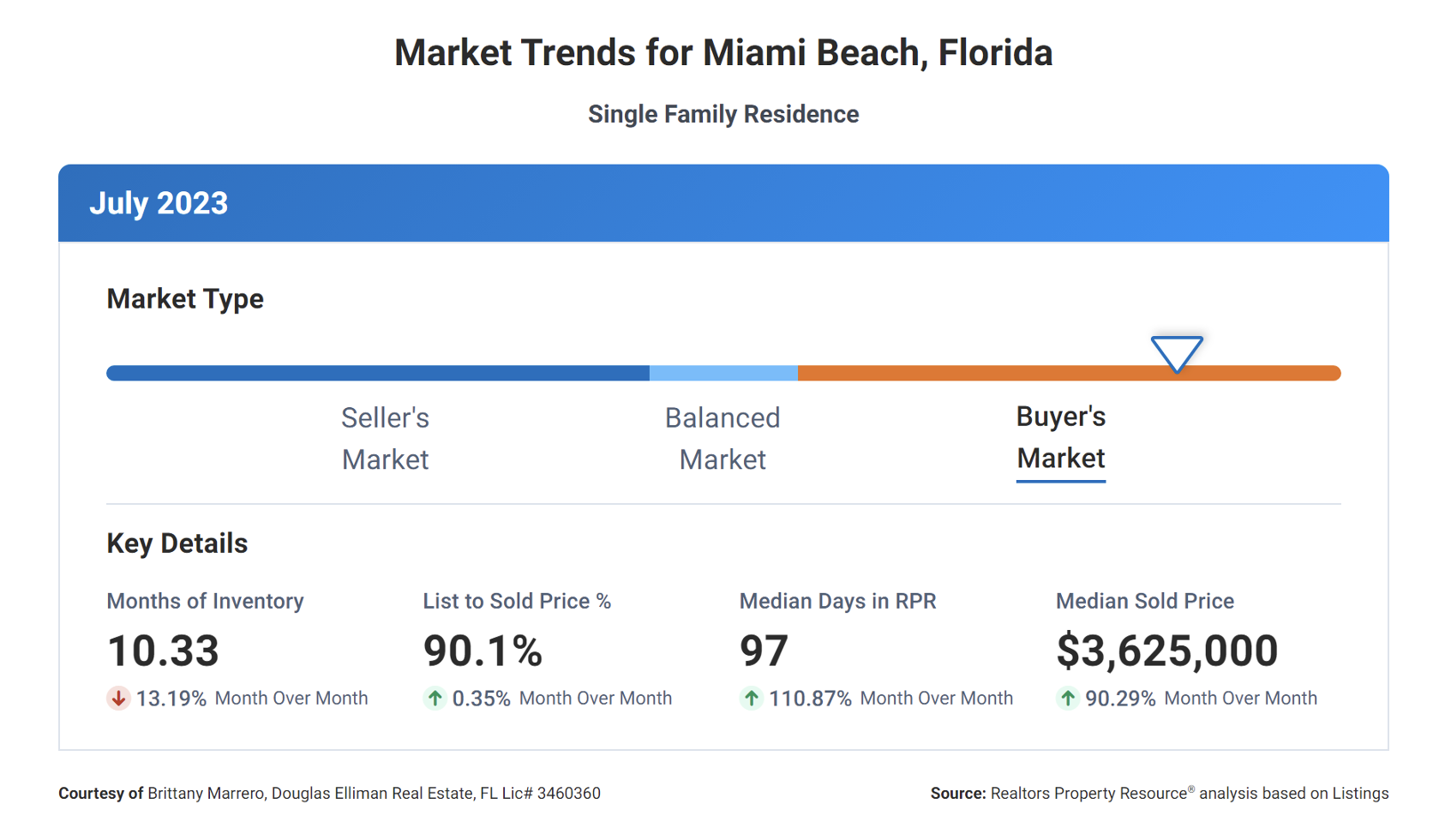

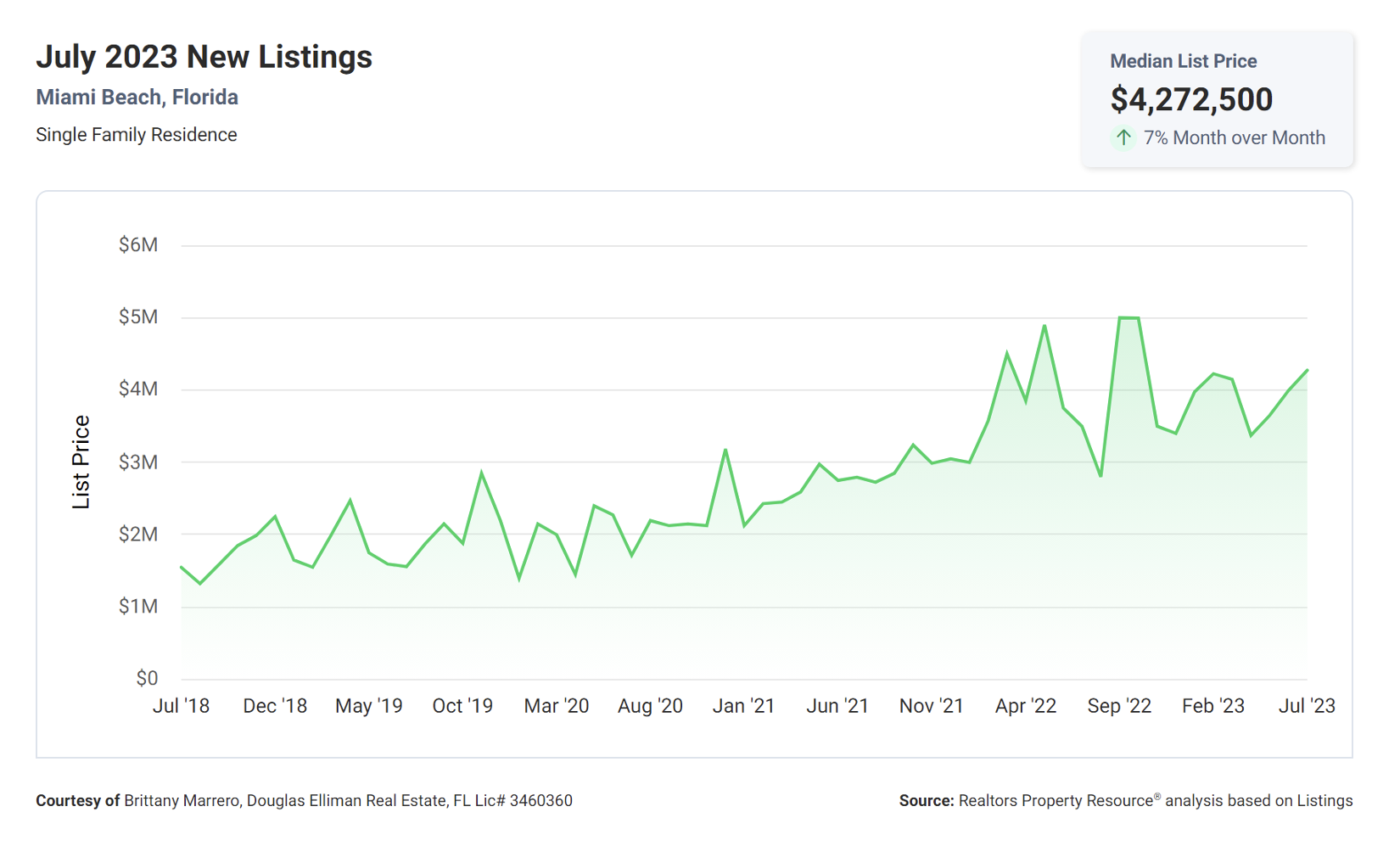

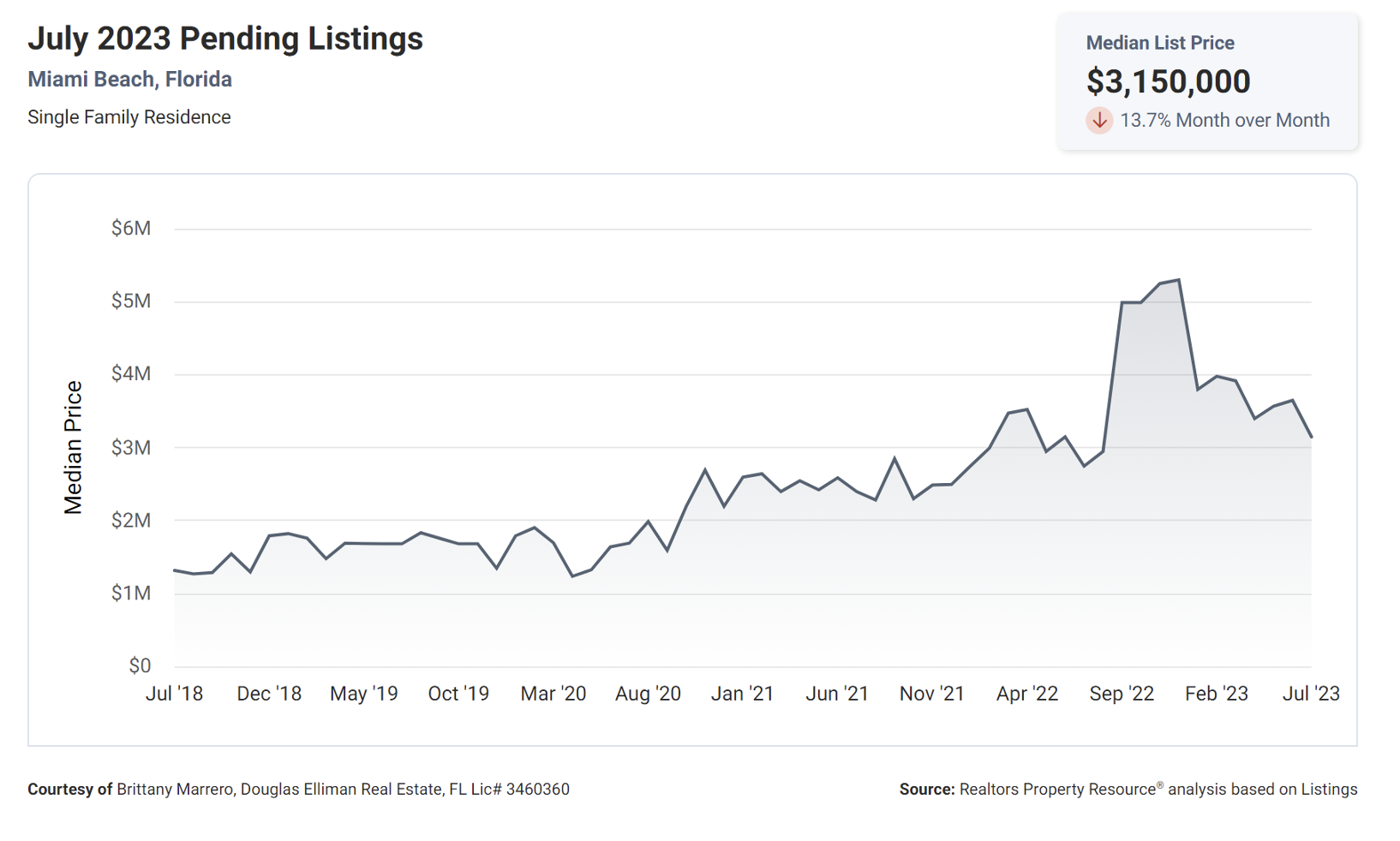

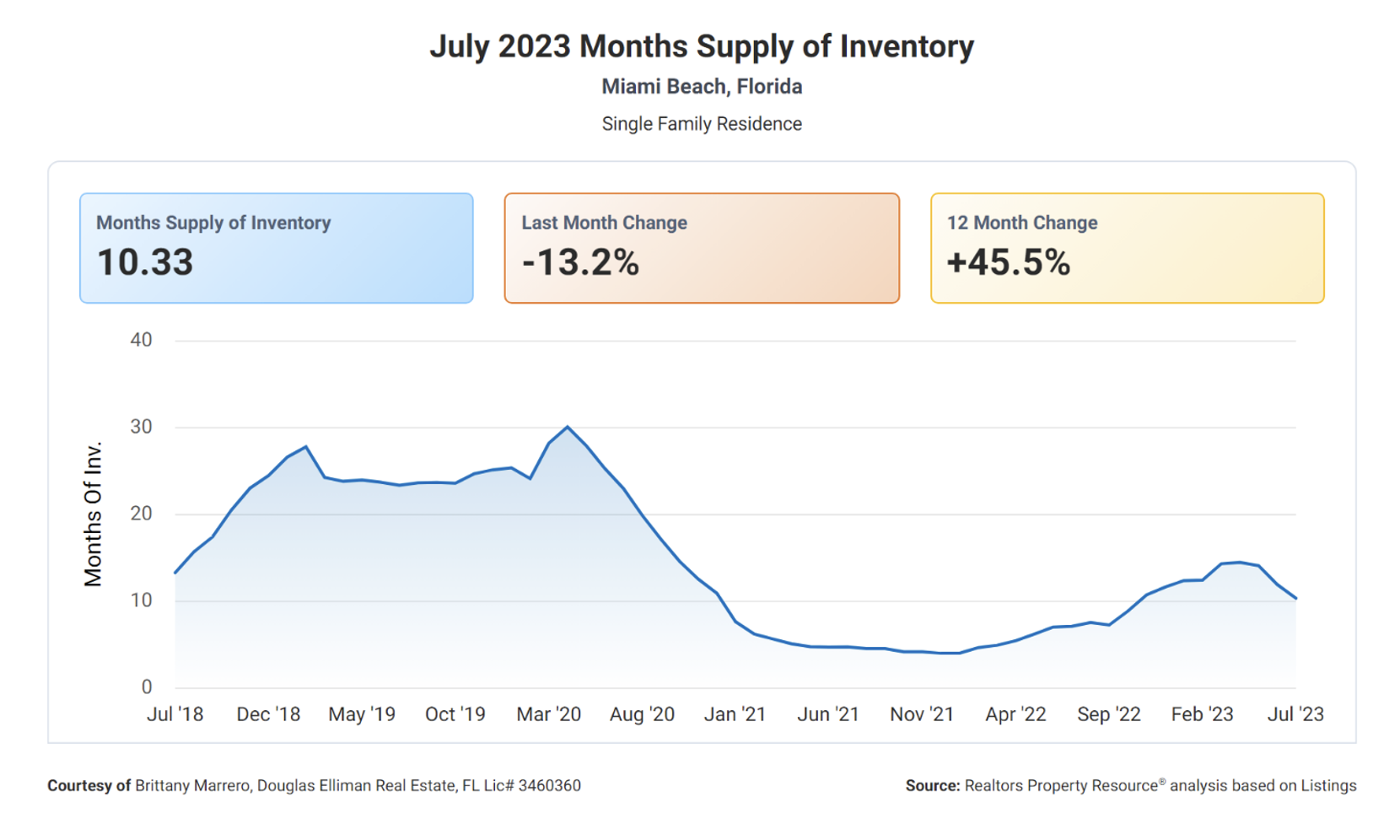

Listing inventory is growing into a more balanced market, which is a good sign. A balanced market likes to see 6-9 months of listing inventory. Miami Beach homes currently have a 10-month supply of inventory. A growing inventory and a more balanced market will increase the listing price discounts that we have been seeing for much of this year. In 2021 and 2022, the market was so hot, that most properties were selling for the asking price or above the asking price. Motivated and realistic Sellers have realized this change in the market and are being more negotiable on their prices to get their property to the closing table.

Additionally, rising interest rates have changed plans for some sellers and some buyers. For sellers that want to sell and then upgrade or even downsize, they are putting this on pause because a new purchase of a property will incur higher mortgage rates, higher property taxes, and higher insurance costs. For buyers with a budget, higher mortgage rates have decreased their purchasing power with already historically high property prices. Buyers with the power to purchase cash have an advantage in today’s market as they are not competing with the pool of buyers as seen in 2021 and 2022.

Advice for Buyers

If you are looking for a waterfront home, you will find more options if your budget allows you to go above $15M. In the $10M-$15M range, supply is limited and often sold at land value (in need of repairs or demolition). Sellers are open to negotiating in today’s market. Listing discounts are averaging 10% and more specifically 13.5% for luxury waterfront properties. Many properties are listed above where they should be. In this case, do your research and make an offer based on what the market dictates today. If the Seller is a real and motivated Seller, they will continue the conversation and get to a deal. If they are “fishing” for top dollar that does not exist, they will stay on the market, and it will be time to pursue other options.

Buyers looking for a non-waterfront home can find impressive properties above $6.5M. Between $4M to $6M, there are decent options as well but more limited. Below $4M, you can find less renovated properties or decently renovated properties on smaller lots. A quality finish still attracts buyers and sells quickly while the poorly finished or in need of renovation tend to sit on the market longer.

Advice for Sellers

Although it is a slower market than in previous years, there is still a high demand, especially for a finished quality product. The overpriced properties are sitting on the market. The properties that do not show well are sitting on the market.

Get your house as “stage ready” as possible and if needed, stage with new furniture to give it a fresh new look (we can assist and guide you through this process). Most importantly, price your home correctly to get as much activity as possible from the day it is listed. Buyers today are both nervous and informed. They will not be splurging, and they want to feel like they are getting a “deal” or at least paying market value. If you try to sell for well above market, the property will sit on the market and not sell. If it shows well and is priced correctly, it should sell rather quickly.

Read our other neighborhood and luxury reports

If you would like to get perspective on other specific neighborhoods or luxury reports. Please click here to go to our main database of reports. We update these every 6 months.

Schedule Time with David Vazquez and David Siddons

FAQ

These are the most commonly asked Google Real Estate Related questions

I see the market is a buyers market, what does that mean?

A buyers market is a market in which there is more supply than demand. Therefore buyers have an advantage. A balanced market is a market in which neither buyers nor sellers have an advantage.

Do you think we should wait for interest rates to go down before buying a home?

Many buyers are waiting for rates to come down. If the rates will come down, many buyers will become active again or current owners might look for alternatives. This will create market activity again, which has been slow in the last few months.

For people that are waiting for interest rates to come down, we have some advice. By the time rates go down, prices will go up again. If you want to buy a home anywhere in the next year, buy it now and refinance later. If interest rates don’t come down it’s because inflation is still high and that’s mostly a consequence of a hot housing market so this also means housing prices will continue to go up. So in almost all scenarios, you are losing by waiting for interest rates to go down.

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS