- Best of All

- Best Miami Luxury Condos

- Most popular

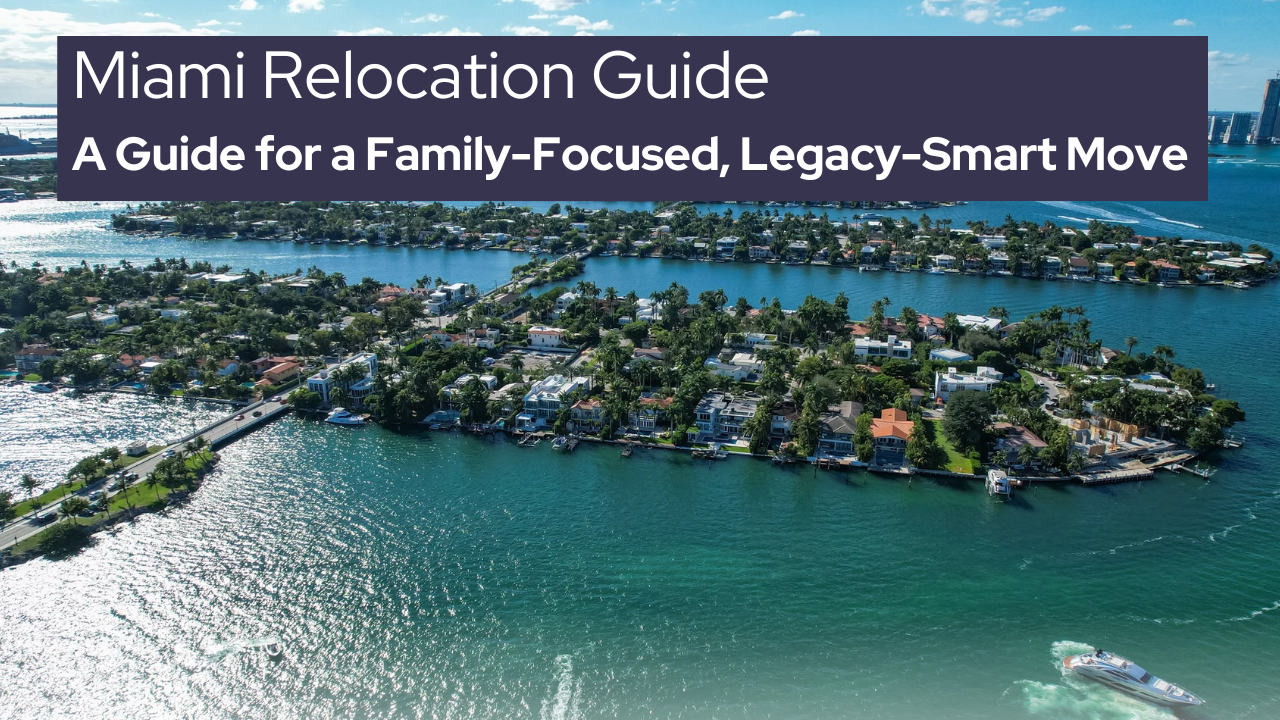

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Relocating to Miami from New York City

How You Can Pay Your Miami Mortgage with Your NYC Tax Savings

New Yorkers see solid reasons to relocate to Miami and buy a property!

This week I had the opportunity to sit down with David Gruen, a Miami-based financial advisor who has helped many New Yorkers with their tax management when relocating to Miami. As a real estate agent I was aware of the tax advantages in Miami and the fact that many New Yorkers are looking south for a second home, but little did I know about the far-reaching tax benefits this move would bring along. I also learned that you don’t need to be down here in Miami all year round, you just need to be out of New York for more than 181 days.

Listen to my entire conversation with David Gruen

The financial benefits of moving from NYC to Miami – From a high tax state to a low tax state

Have you ever wondered why the Giants and the Jets are playing in New Jersey and not actually in NYC? Because NY taxes are 14,4 % while Jersey taxes are about 8%. New York’s hefty tax bills are the reason many residents are leaving the city while others are trying to find a loophole that allows them to both be in New York City while also avoiding the city’s taxes. Avoiding the NYC taxes is a big deal and many New Yorkers are now seeking split residency between NY and Florida, which allows them a luxurious Miami lifestyle (including a Miami property) with the money they saved in taxes.

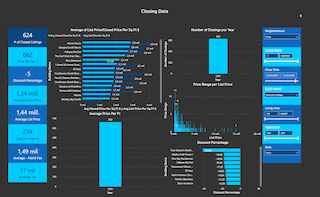

An actual example of a New Yorker’s Tax Benefit when moving to Miami

- Income Level: $2M a year

- NYC Taxes are 14,4% which is $288,000 (that is $288,000 more than in Miami)

- On a separate note a New Yorker pays roughly 58% taxes so he is left with about $840K

- the $288K tax bill translates into $24,000 monthly tax payments

If you put 24K in a mortgage in Miami you would be looking at a $3,5Million property (this excl taxes and insurance). But this is a “free home” as you would put your NYC tax benefits to work in a Miami property while you get to keep your NYC home as well.

Finding the Benefit

If you are in New York for more than 181 days per year you will need to pay taxes. NYC is a high-income tax state and for that very reason the government will try to keep you there as much as possible. If you would find a way to spend less than 181 days in NYC you can avoid the 14,4% tax bill. Many New Yorkers move to Miami or reside in Miami for the majority of the year as this state does not have income tax while it provides for a luxurious lifestyle. The Florida government doesn’t care how long you are in Miami, so for split residents it only matters that you are NOT in NYC for 181+ days. You could spend the summer in Europe, Miami or wherever as long as you stay away from NYC.

It is important to know how NY counts the days. If you stay overnight in NYC, the state sees that as a 2 day stay. If you fly internationally from NYC to Barbados for two weeks,every day you spent in Barbados counts as a day spent in New York City. Newark airport in Jersey exists to be a Benefit for NYC residents to not be in NYC. You drive to Jersey, catch a flight out and these days don’t count as NYC days.

In the end it is just a lifestyle constraint. You can save a lot of money, but you can only be in NYC for about 5 months max. Many of David Gruen’s clients set up their life in this way and are happy with it. For example when they go to NYC for business they make sure they don’t spend too many days there and when Christmas approaches and they have spent close to 181 days in NYC already, they rent a Jersey hotel room to spend time with their family and still be able to profit from the enormous tax breaks. They have a home in NYC, but they just uber to their home from the hotel to not be officially in NYC

This dual residency of wealthy New Yorkers in quite the trend at this moment with websites explaining how to profit from this Benefit. For example there are sites providing you with three-leg trips leaving from for example Miami, with an overlay in NYC to a destination outside NYC. You don’t take the first leg of the trip (Miami to NYC) so it shows you took flight from Miami and NYC does not count your stay as NYC-credited days.

Schedule Time with David Siddons (via Zoom/Call or in Person)

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS