- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Investing in Miami Luxury Real Estate – How Does Each Neighborhood Compare by Performance?

Investing in Miami Luxury Real Estate | What to Buy and Will This Market Keep Moving?

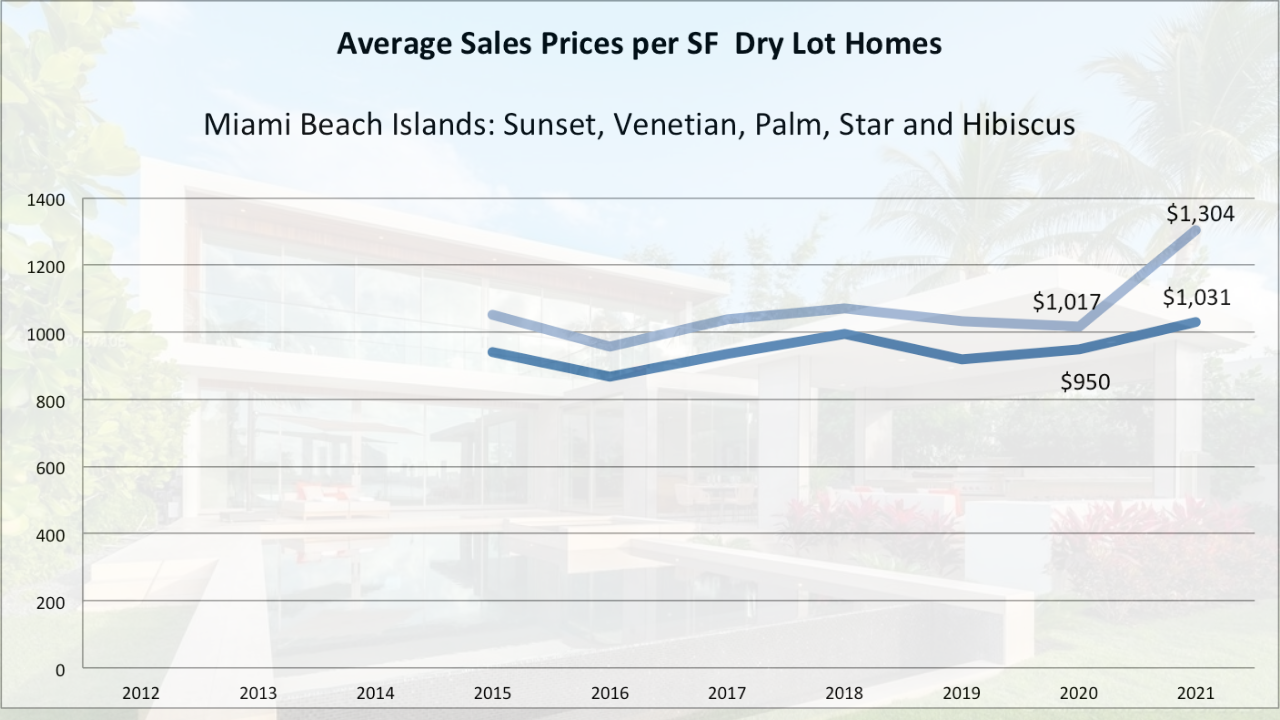

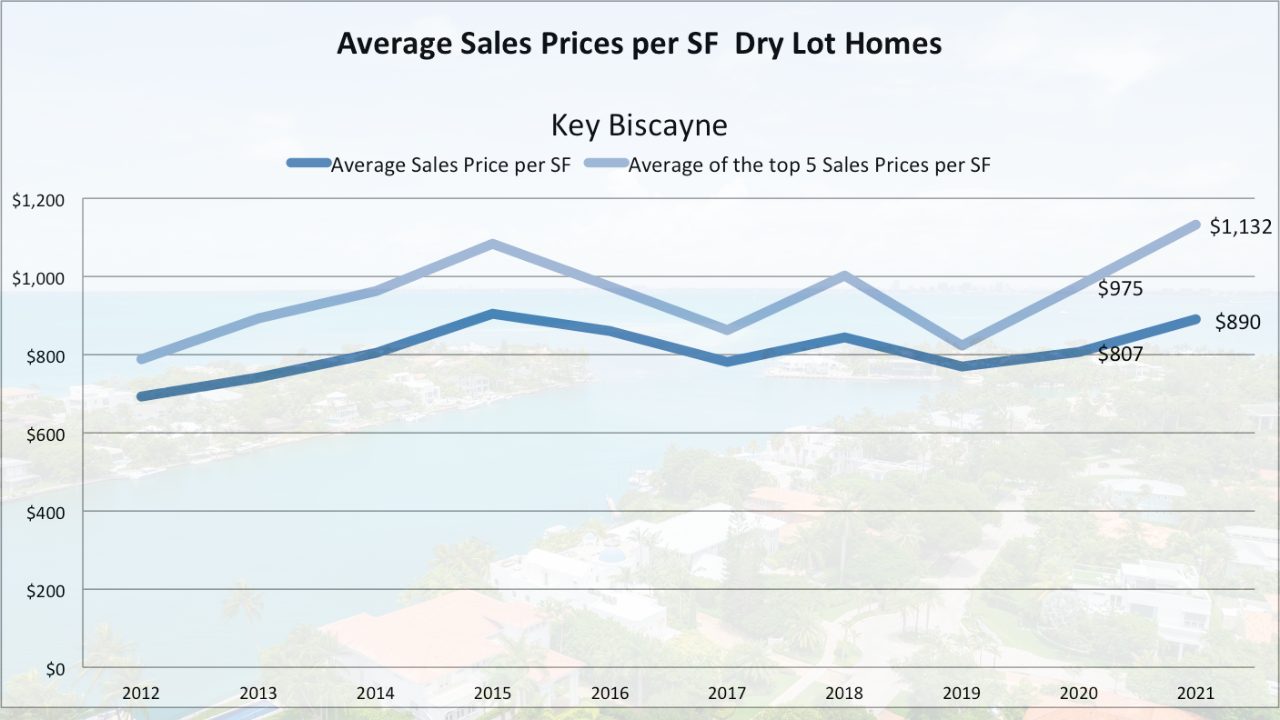

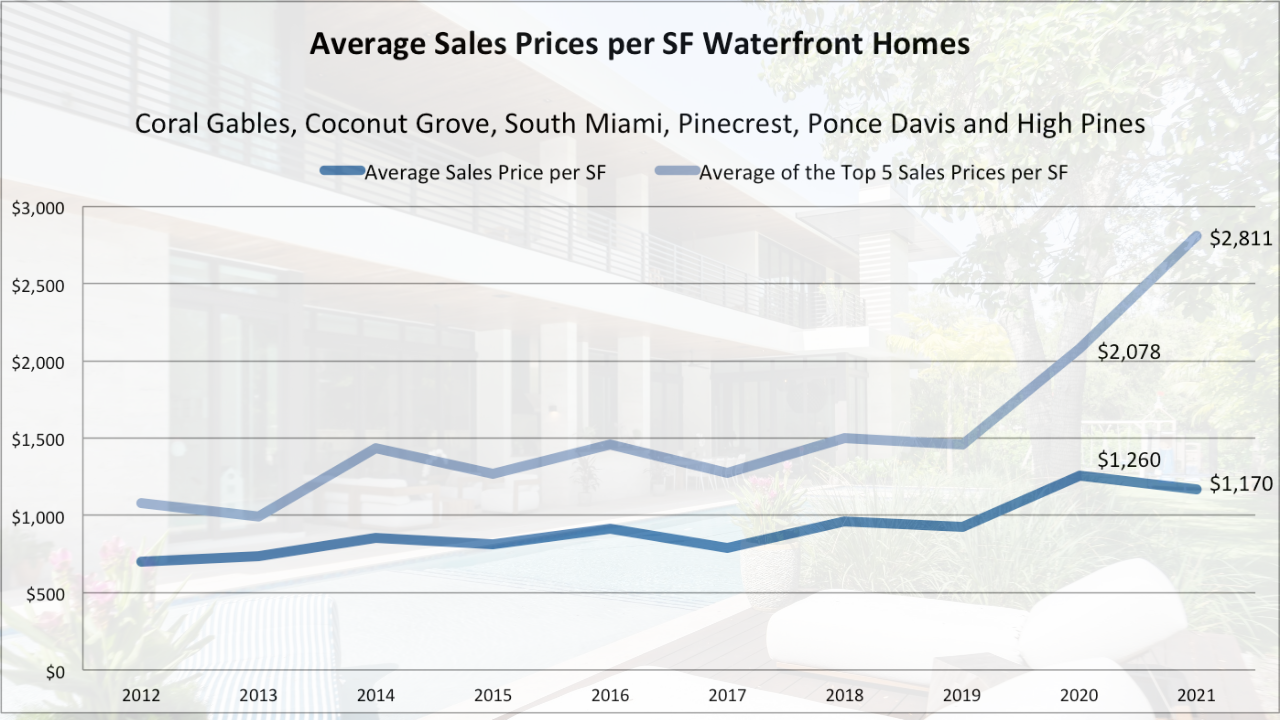

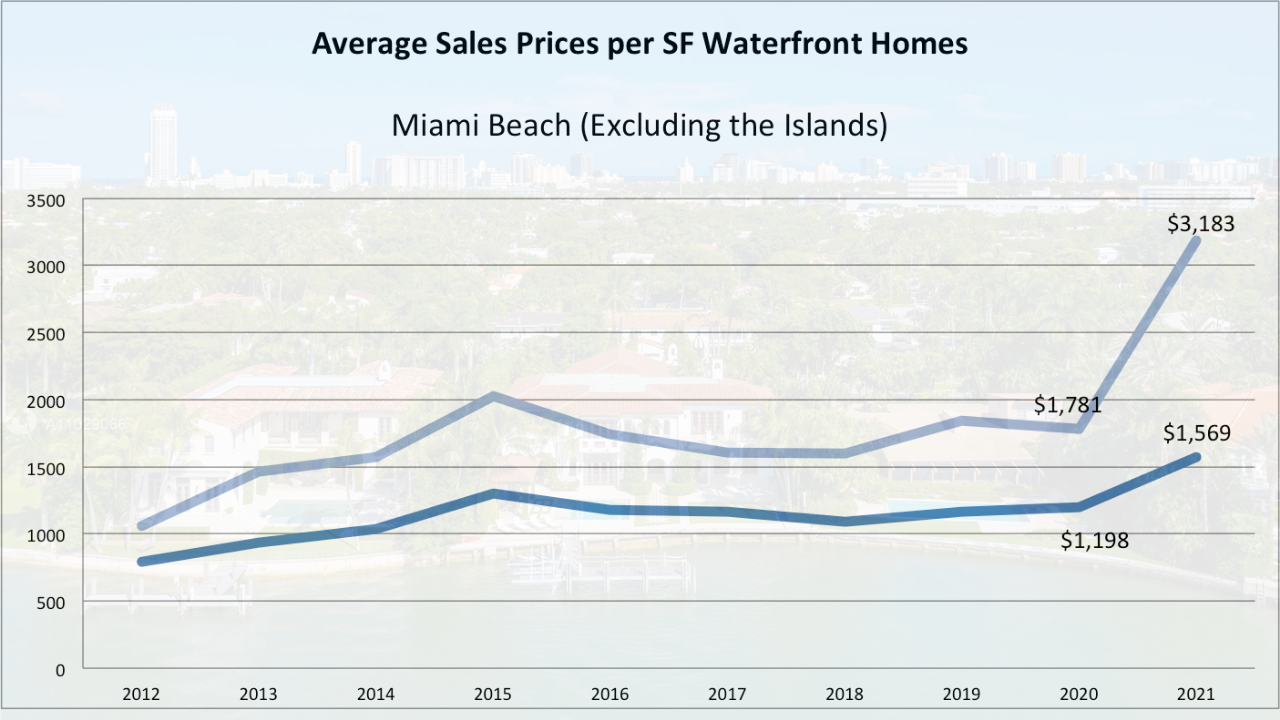

The Miami real estate market is moving extremely fast, and it is time to put the numbers in perspective. In this article we will show you how the different neighborhoods have performed in the last 10 years with a secondary focus on the last 24 months. For this blog the focus is on single-family homes. We compare the primary residential areas¹ of Coconut Grove, Coral Gables, Pinecrest, South Miami, Ponce Davis and High Pines with Key Biscayne, Miami Beach and the Islands of Miami Beach (Venetian Islands, Palm, Hibiscus and Star Island as well as the Sunset Islands). As we focus uniquely on the luxury real estate market we only considered properties in the $3M+ range. We compare the performance of dry lot homes in the different areas as well as the performance of waterfront homes. It will discuss some of the greatest investment returns we have seen; which leads us to the golden question: “If I’m an investor what should I invest in next?“ and “Am I going to be paying at the top of the market?” The reality as with every city is that you HAVE TO get granular and delve into each price sub-market. So let’s look at the average sales prices per SF and the peak prices per SF (Average of the top 5 sales) from 2012 to 2021 (till Sept 1).

Mass Migration and a Lack of Supply are Leading to Record Sales Prices in the Miami Market

Investing in Miami Luxury Real Estate | How Have the Different Areas Performed over the last 10 Years?

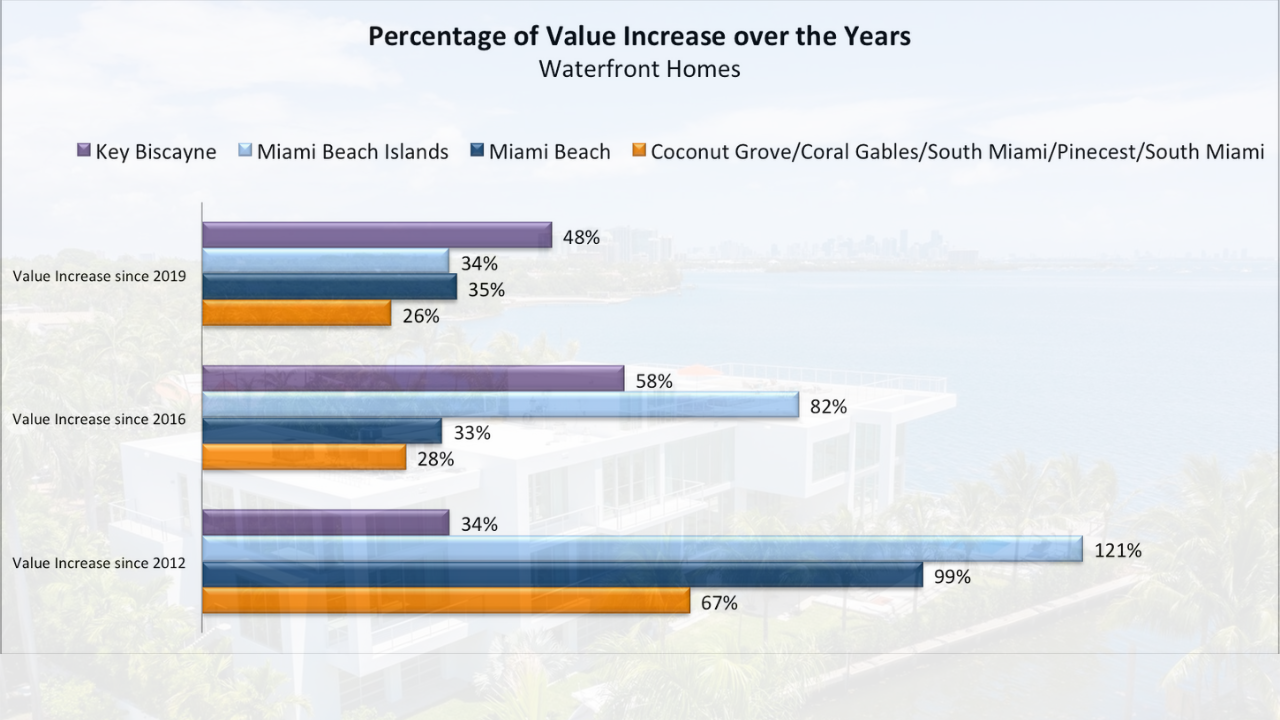

Looking at the graphs for dry lot homes we see that Miami’s single-family home markets have been steadily increasing over the last 10 years. The markets that saw its value increase the most were Miami Beach and the areas around Coral Gables. Miami Beach however saw a sharp increase in value in the last two years of Covid, with many relocation buyers opting for a home on the beach. The areas around Miami’s private schools however have seen a very strong last two years as well as a steady appreciation over the last 10 years.

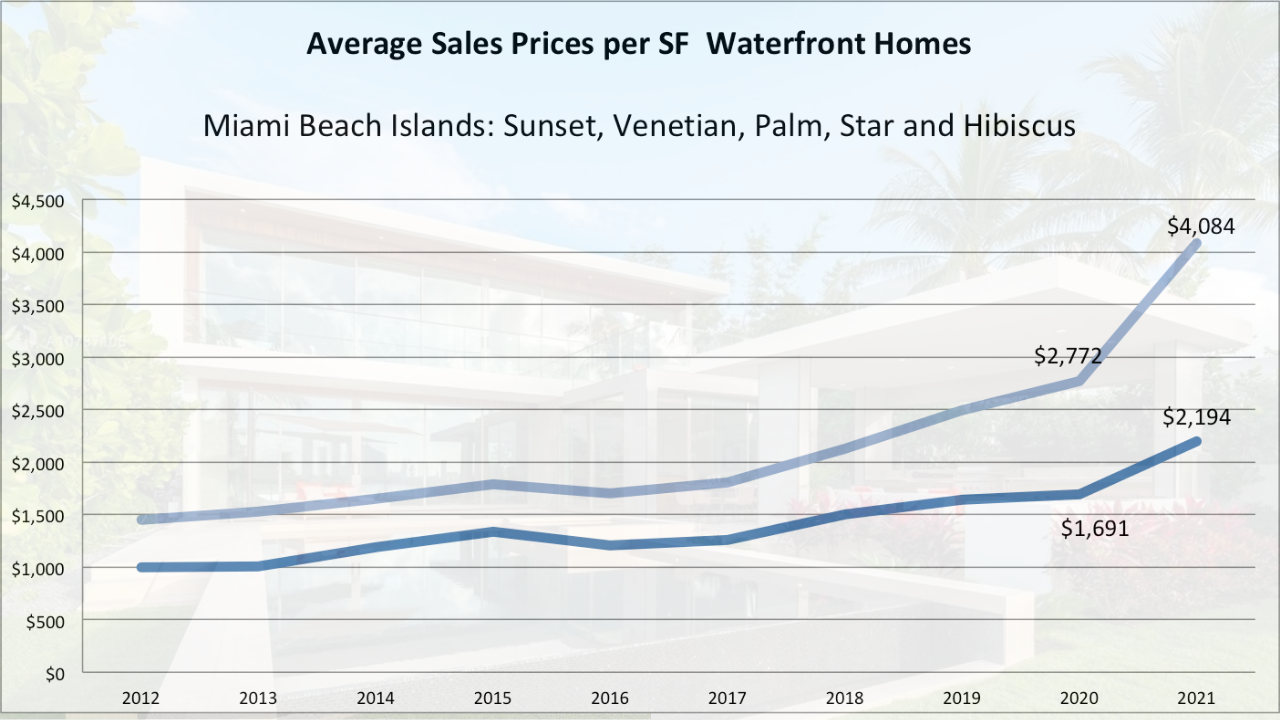

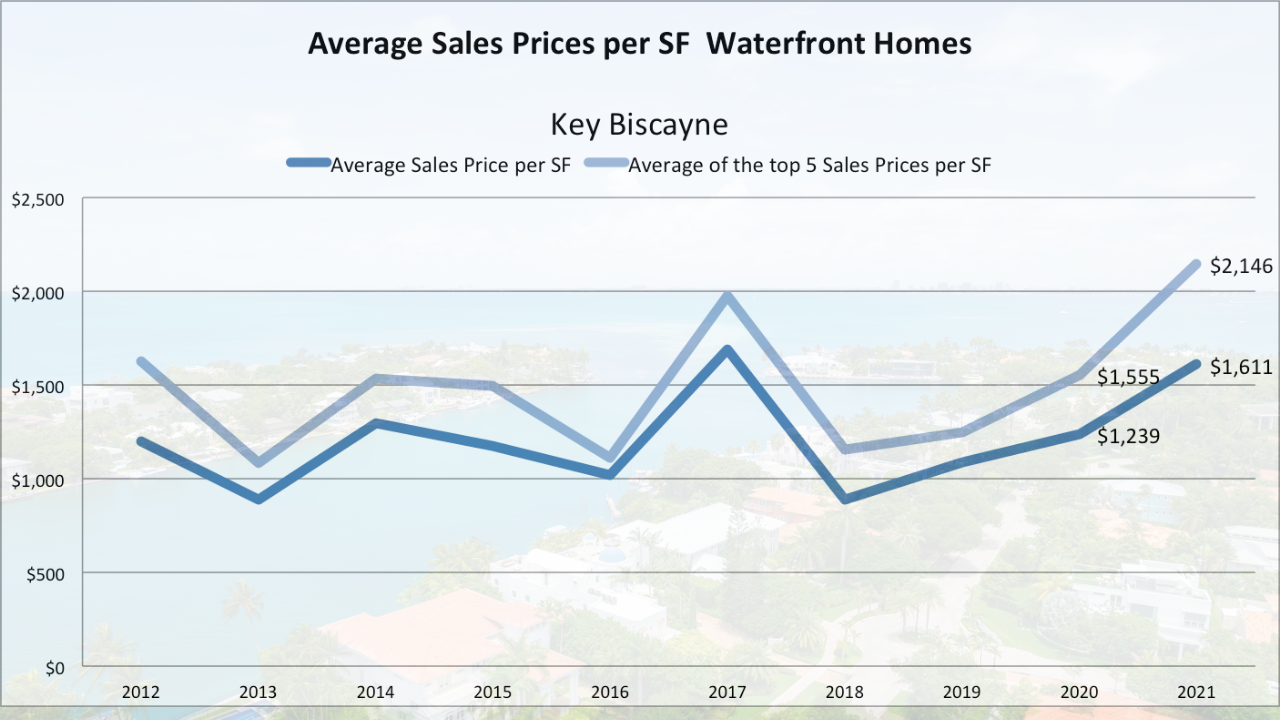

For waterfront homes we see that the islands around Miami Beach made the biggest jumps over time while also presenting a steady growth over the last 10 years. Of course the islands have been the home of many new construction projects, which pushes up the prices.

Average and Peak Sales Prices per SF for Dry Lot Homes in the Last 10 Years

Average and Peak Sales Prices per SF for Waterfront Homes in the Last 10 Years³

Average and Peak Sales Prices per SF for Waterfront Homes in the Last 10 Years

Please note that the average price per SF for Miami Beach Waterfront Homes in 2021 is $3,183. This number includes the sale of three Oceanfront homes in Altos del Mar. Without these oceanfront homes, which are extremely scarce in Miami Beach and sell for a surplus, the average sales price per SF would have been $2,641

Investing in Miami Luxury Real Estate | Will the Luxury Market Keep Moving?

With the market moving this fast, it will no doubt make some buyers obviously question whether the market will keep moving like this? We cannot foresee the future, but we can look at the factors driving supply and demand. For this market to stop moving, supply either needs to go up or demand needs to cool down. For those interested we wrote a more elaborate article on the sustainability of the Miami real estate market on our blog.

Regarding the demand for Miami real estate, we still see many relocation buyers coming into Miami. The Pandemic has accelerated the movement, but even after the pandemic, Miami will keep growing. Florida’s popularity isn’t expected to end any time soon: it’s expected to gain an average 845 new residents a day until 2025, according to state projections and according to the Beacon Council Miami-Dade County’s population, currently counting 2.7 million residents, is estimated to reach 3 million in 2025.

Lets also not forget that the Pandemic was just an accelerator and not the main reason people were moving to Miami. Florida’s favorable tax laws will unlikely be changed in the near future and the same applies to the state and tax policies of those states whose residents are moving to Miami. This ensures a continuous flow of migration buyers. Furthermore, Miami is very skilled in keeping these migration buyers here and to bring the entire city to the next level. One strong force in achieving sustainable growth is Miami’s Mayor Francis Suarez, who is doing a great job in making Miami the new Silicon Valley. Mayor Suarez is now promoting Miami’s business-friendly environment and the city’s responsiveness to the needs of the incoming tech companies. Now these tech entrepreneurs are coming and they are not just bringing their businesses, they are creating new businesses, new jobs and lots of investments and capital will be flowing in. Already a hotspot for banking and financial services, Miami is now attracting more hedge funds and private equity firms than ever before. Miami is changing and is growing sustainably. People come for its tax climate and never leave because of its lifestyle, new opportunities and climate.

On the supply side we notice that there is a shortage of homes. Many sellers realize they can get top dollar, but do not necessarily know where to go to next. Opting for a rental is not favorable now given that the rental market is even tighter and rental prices are extremely high. There is a lack of new condos (as alternative to a home) and a lack of brand new construction homes. With other words, the supply side of this Miami market is extremely tight with no potential change in sight. Biden’s proposed new Capital Gain Tax Plan might lead to some home owners to sell their home faster than anticipated, but that will not have too much of an impact on the single-family home markets. The result of this tight supply is that good quality homes get multiple offers, prices are up and more and more properties are traded off-market for “Make-me-move” prices.

As you can see from the graphs above the main single-family home markets have always been stable. Some years it might have slowed down on the upper end of the market, but we have always seen healthy, upward markets. Do we expect this market to drop? No, you might expect it to level, but we doubt it will drop. Demand is up, supply is extremely limited. This is to say that the market won’t go down in many cases, but outlier properties that suddenly sell at 50% more than they sold 2 years ago (so called “Make-me-move” offers) will become less likely. With other words, we will see less anomalies in property prices as exceptions to the rule will cease to exist. These anomalies are caused by hysteria and this will stabilize soon. Sellers can only profit from massive gains in a certain window, which is NOW. This window of opportunity will go away in the next months and the market will level.

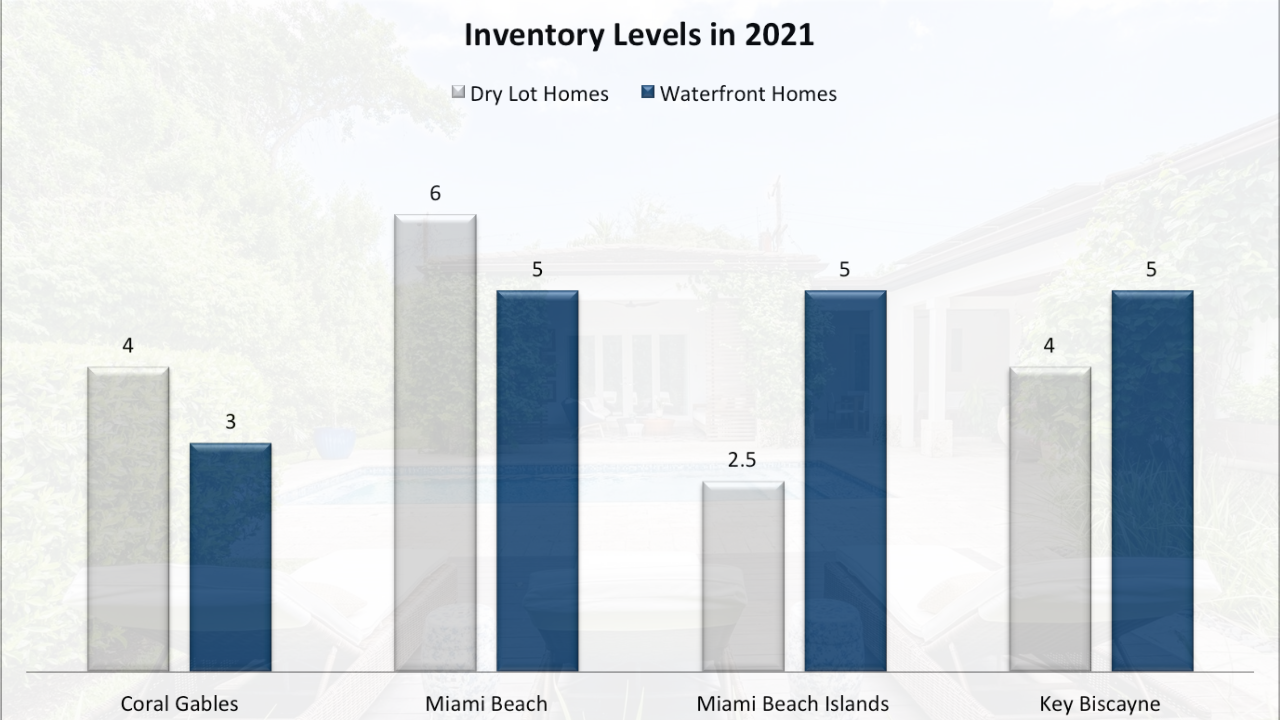

Inventory is very low and the inventory levels will have to explode for the market to go down. We see some new homes being built, but these are sold before they are finished, fixer uppers and land opportunity are extremely scarce as well.

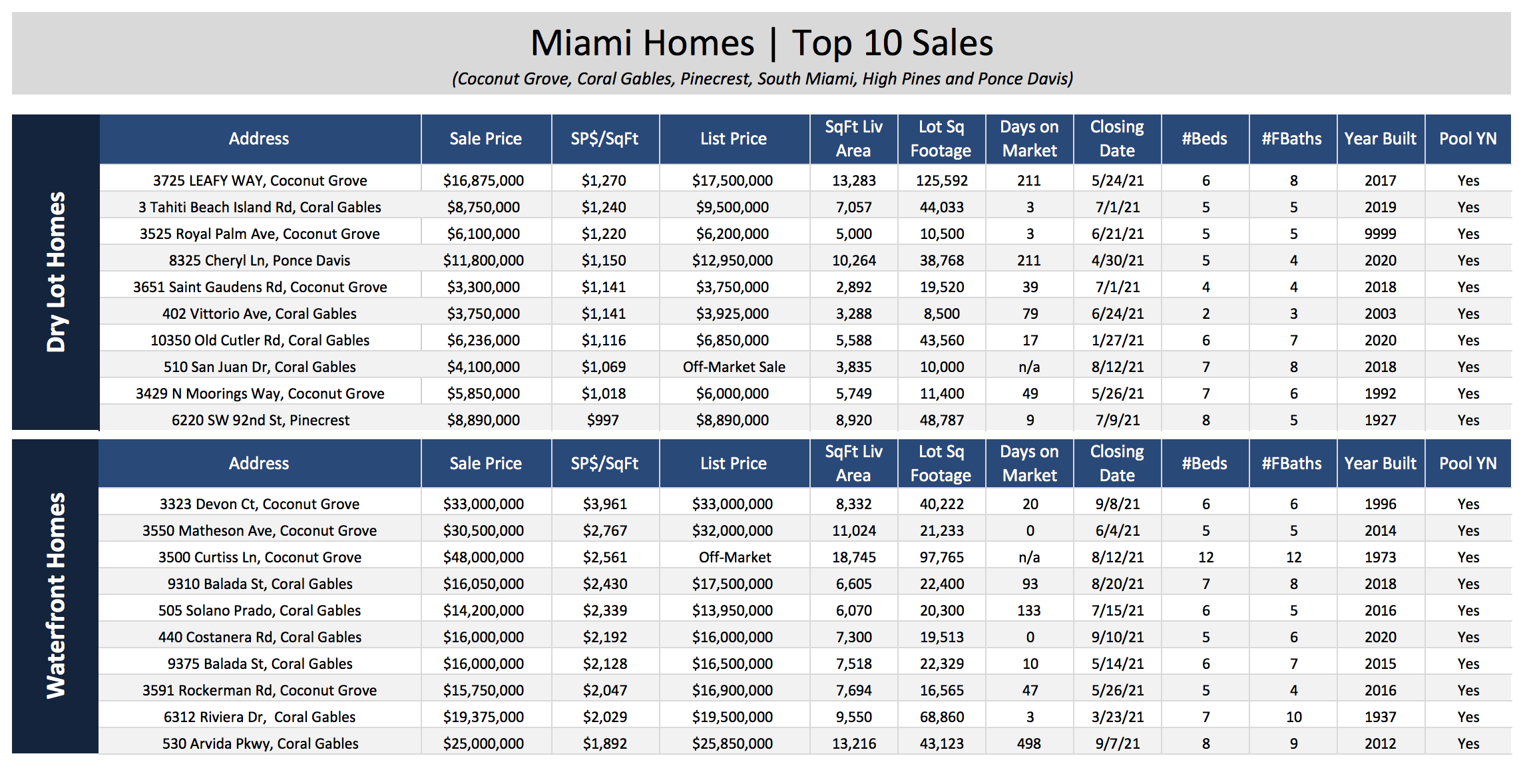

T0p 10 Sales Prices per SF per Area (For Dry Lot and Waterfront Homes)

T0p 5 Sales Prices per SF in Miami’s Main Residential Areas

Top 5 Dry Lot Homes

Top 5 Waterfront Homes

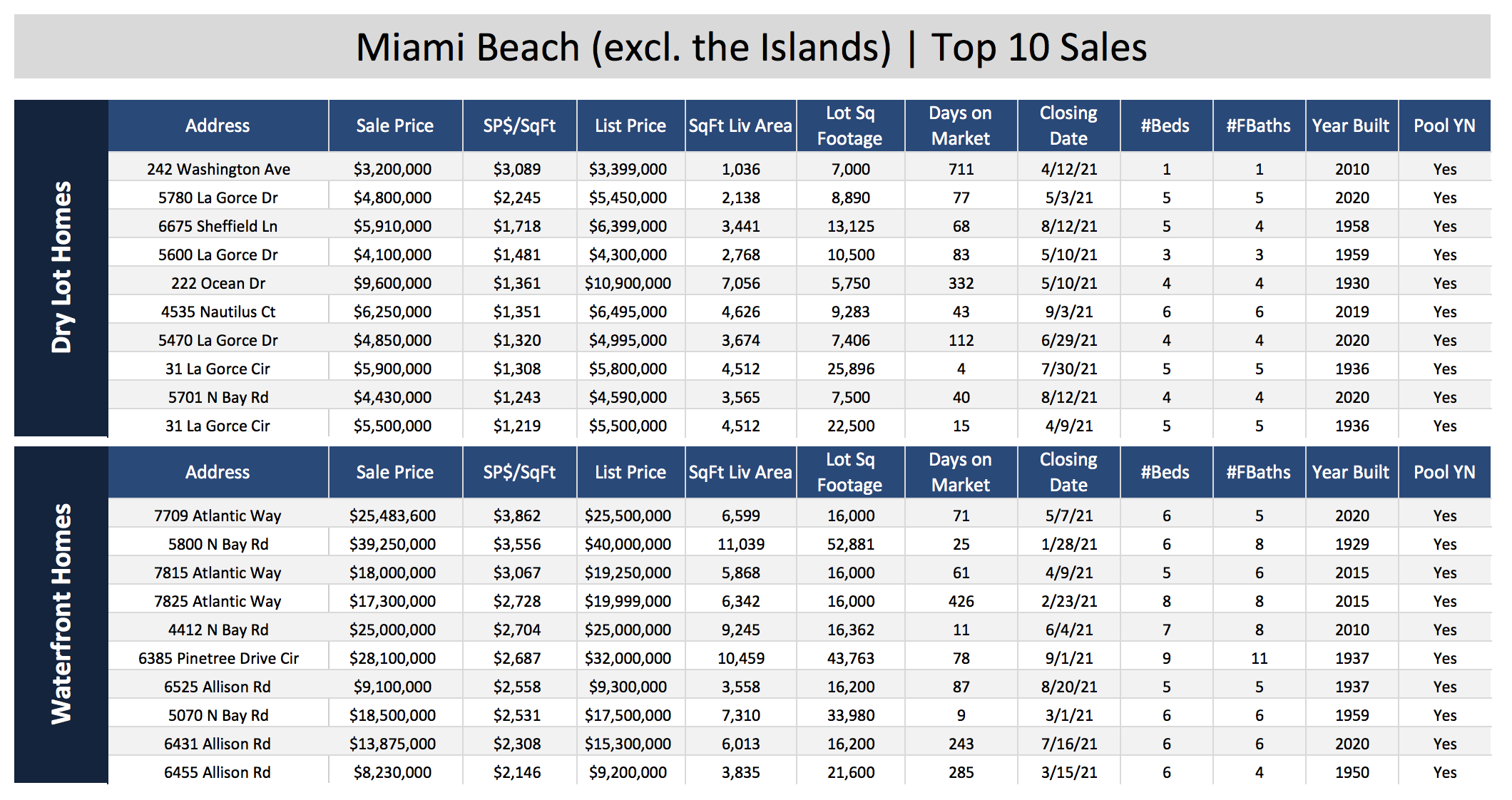

T0p 5 Sales Prices per SF in Miami Beach (Excluding the Islands)

Top 5 Dry Lot Homes

Top 5 Waterfront Homes

T0p 5 Sales Prices per SF for the Miami Beach Islands

Top 5 Dry Lot Homes

Top 5 Waterfront Homes

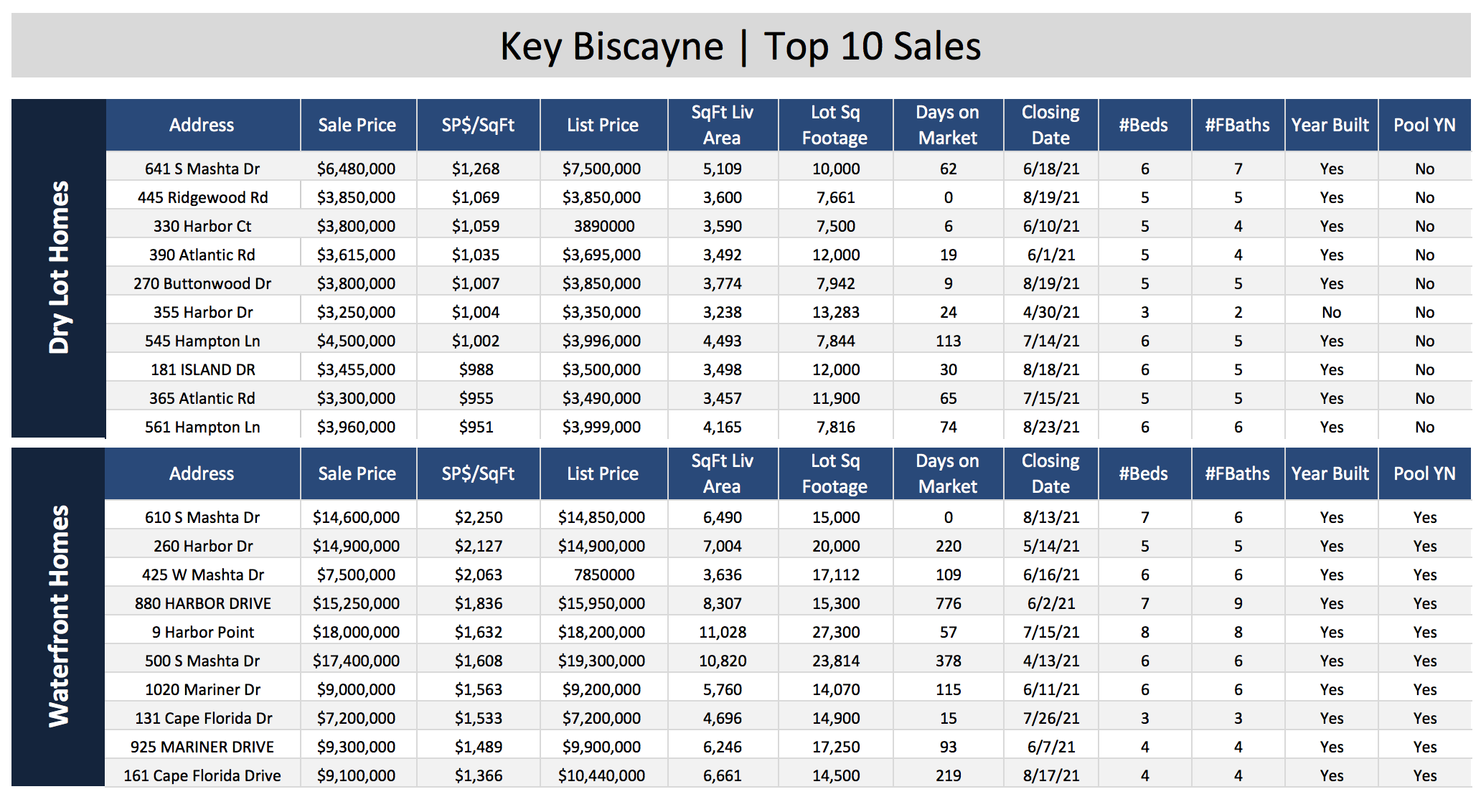

T0p 5 Sales Prices per SF in Key Biscayne

Top 5 Dry Lot Homes

Top 5 Waterfront Homes

¹We consider the areas of Coral Gables, Coconut Grove, Pinecrest, South Miami, High Pines and Ponce Davis the primary residential areas. These form part of the residential core around Miami’s best private schools and are therefore often blended as one by relocation buyers.

² Footnote from graph Dry lot Homes

- The sales numbers of 2021 are taken over January 1 till September 1.

- All included properties are in the $3M+ range.

- Pure land deals are excluded to not contaminate the results.

- If less than 15 homes were sold in a certain year the average of the top 3 sales was used to reach to the top market prices per SF instead of the top 5.

- If less than 3 sales happened in a certain year we did not include the data results in this study.

- Some of the years less sales happened in a certain neighborhood which makes the data set smaller

- For Miami Beach we saw 10 or less dry lot sales in the years: 2014, 2015, 2016, 2018 and 2019

- For the Miami Beach Islands we saw 10 or less dry lot sales in ALL the years apart from 2021

- For Key Biscayne we saw 10 or less dry lot sales in the years: 2012, 2017, 2018 and 2019 and less than 10 waterfront sales in the years 2014, 2015, 2016 and 2019

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS