- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

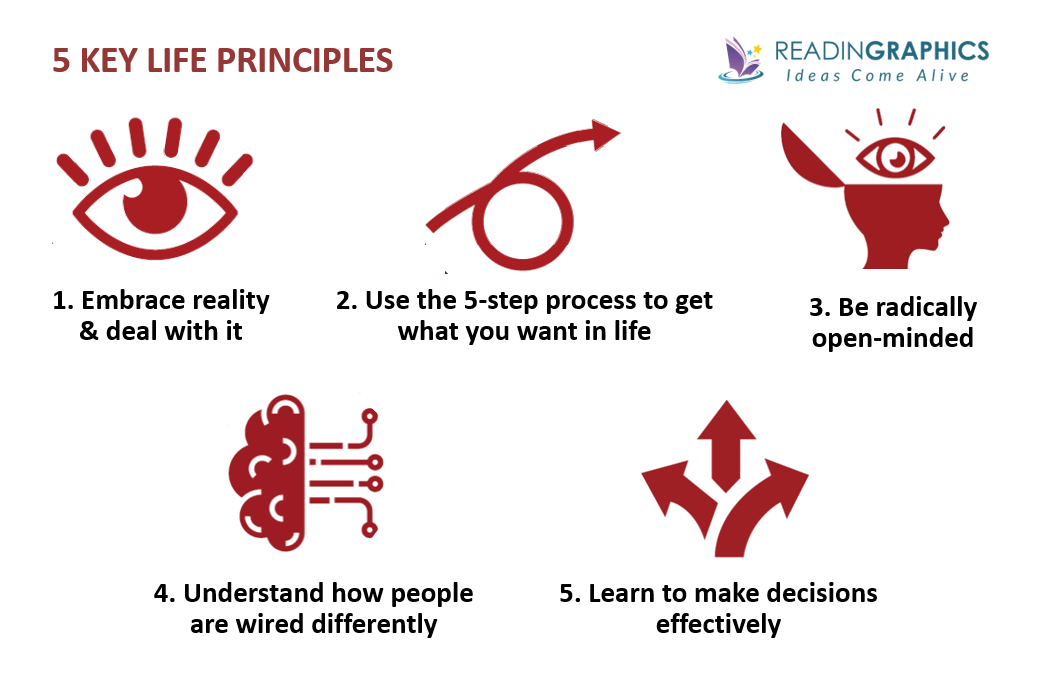

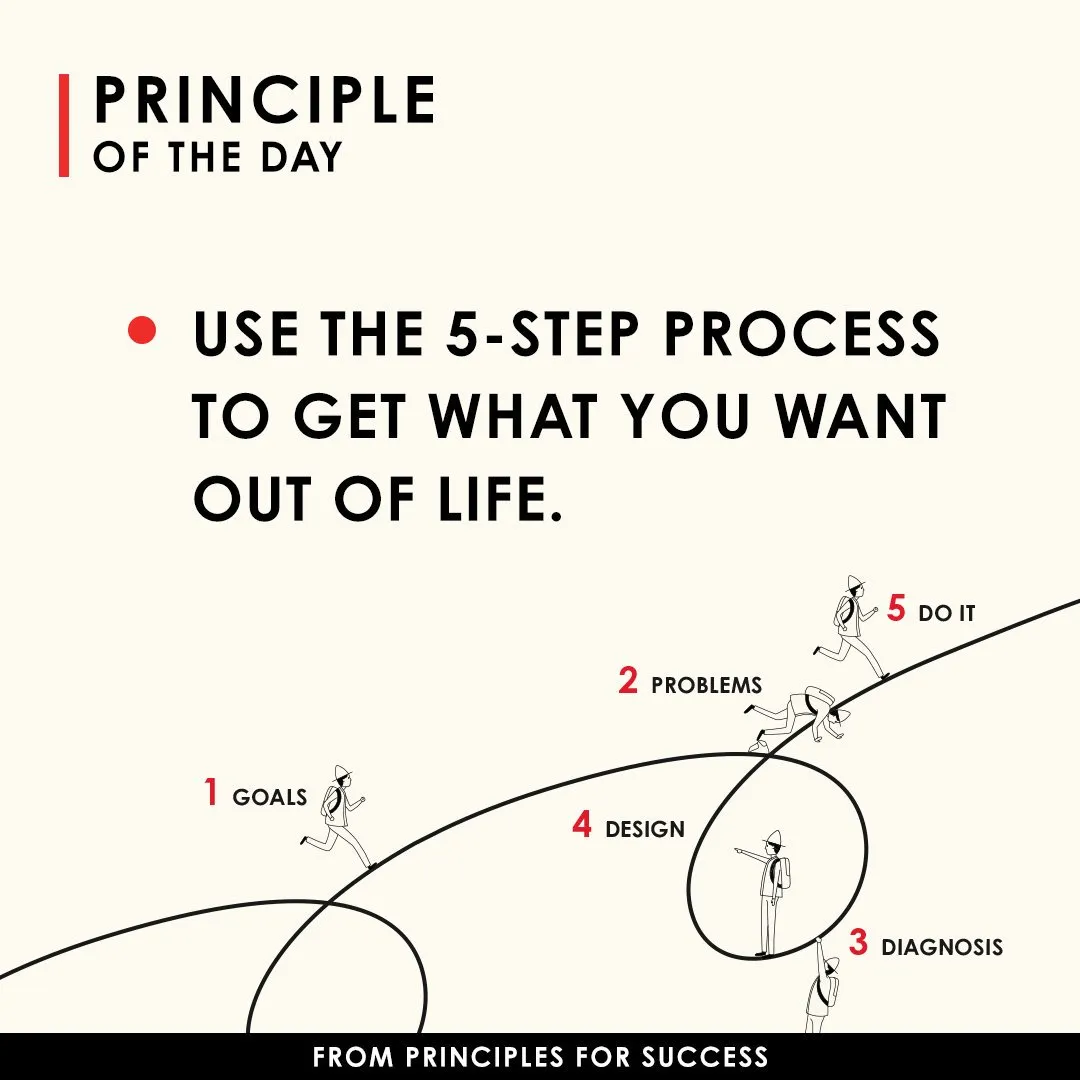

Applying Ray Dalio’s Principles to Analyze and Invest in Miami Real Estate!

Gain Clarity, Objectivity, and Precision in Identifying Opportunities!

If you’ve been following my blogs, podcasts, or reports for a while (I’ve been doing this for about 15 years), you probably know I’m a huge fan of Ray Dalio. His book Principles has been a major influence on how I approach my business and how I aim to add value for my clients. With that inspiration in mind, I wrote this blog, imagining what advice I might give on Miami real estate if I were Ray Dalio. Here’s what I came up with…

1. Embrace Reality and Deal with It

3. Be Radically Open-Minded

The Miami real estate market is complex and diverse. It’s easy to think you know it all, but in reality, having an open mind is crucial. Always be willing to learn from experts in the field—whether it’s your real estate agent or economic analysts. Listen to different perspectives, understand the dynamics of various neighborhoods (such as South Beach vs. Coconut Grove), and stay open to unexpected opportunities.

4. Understand That People Are Wired Differently

When analyzing real estate, understand that buyers and sellers are driven by different motives. Some sellers may be emotionally attached to their homes, while others are purely looking for profit. Knowing the psychological motivations behind real estate transactions can give you an advantage. For example, in Miami’s luxury market, a seller might value prestige and exclusivity over a simple financial transaction. Cater your approach accordingly.

5. Be Radically Transparent

Transparency is key when dealing with real estate transactions. Make sure you have full clarity on the property’s condition, title, zoning laws, and long-term maintenance costs. Have everything in writing, from inspections to contracts. Transparency ensures fewer surprises later and builds trust with everyone involved in the transaction.

6. Look at the Machine from a Higher Level

Just as I look at the economy as a big machine, you should view Miami’s real estate market as part of a larger system. Understand how macroeconomic factors like interest rates, inflation, and migration patterns affect the local market. For instance, Miami has been a popular destination for those relocating from higher-tax states like New York. Recognizing these broader trends will help you see where Miami’s real estate is headed.

7. Make Decisions as Probabilistic Outcomes

No investment is risk-free, and that’s especially true in real estate. Instead of focusing on guarantees, think in probabilities. What are the chances that the property will appreciate at a certain rate? What’s the likelihood that short-term rental demand will rise in a particular neighborhood? Make decisions based on the most likely outcomes, not based on extreme scenarios, either overly optimistic or overly pessimistic.

8. Know Where You Are in the Cycle

Just like financial markets, real estate moves in cycles. Miami’s market has seen booms and corrections. Knowing where you are in the cycle—whether it’s a buyer’s market or a seller’s market—is essential to making good decisions. For example, if you’re buying at the top of the market, the risk of a future downturn could influence your pricing strategy. On the other hand, buying during a lull might offer opportunities for value appreciation later.

9. Manage Risks

Real estate investments come with risks, but by understanding and managing them, you can maximize rewards. For instance, in Miami, factors like hurricane risk, flood zones, and insurance costs should always be part of your decision-making process. Make sure your investment aligns with your risk tolerance and that you have strategies in place to mitigate potential losses.

10. Don’t Confuse What You Wish Were True with What Is True

It’s easy to fall in love with a property or assume that a market will always go up. However, emotional attachments or wishful thinking can cloud your judgment. Always separate your emotions from the facts. Does the property truly align with your financial goals, or are you being swayed by a beautiful view? Does the data suggest strong future growth, or are you banking on an overly optimistic market rebound?

Conclusion on applying Ray Dalio Principles to Miami real estate investing

By applying these Ray Dalio principles to your Miami real estate decisions, you can think more clearly, manage risks more effectively, and make better investments. Whether you’re considering buying a luxury condo in Brickell or investing in a beachfront property, these timeless principles will help you analyze opportunities with clarity, objectivity, and precision.

For deeper insights or personalized guidance on navigating the Miami real estate market, contact David Siddons Group today. We’re here to help you apply these proven principles to make better real estate decisions.

Schedule a Meeting with David (In Person or via Zoom)

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS