- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

2024 Market Outlook with Eli Beracha (FIU) – Forecasting the 2024 Miami Real Estate Market

Summary of Expectations for Miami Real Estate in 2024

We sat down with Eli Beracha, Director and professor at the Hollo School of Real Estate in FIU, and discussed the realities of the market in 2024. Looking at the forces at play and our predictions for the rest of the year. We explain in greater detail what is happening, why, and what will happen next. This podcast navigates the subject with a combination of academic studies and real-world applications and observations…..

2024 is a year of change. We know Miami is a growing city, and significant company moves with significant investment make our long-term outlook VERY bullish. In the last three years, we have seen unprecedented property price increases but we recognize that the markets now require some ‘stabilizing’ and balancing out. Trees do not grow to the sky, and markets need time to breathe and settle down after massive periods of expansion, which is what we expect to see more of in 2024.

This particular podcast episode is a fusion of real-world experience with academic research. Eli isn’t a real estate agent, and he doesn’t have a personal stake in the residential market. As a real estate professional and analyst, I have layered on top of Eli’s viewpoint some key data designed to help both buyers and sellers. I hope that my expertise will help you make a better decision, and also give validity to you hiring me as your advisory agent in the purchase or sale of real estate.

The 3 ‘big’ factors affecting today’s market

1. The market needed to take a breath

Almost all Miami neighborhood markets went up in price very aggressively between 2020-2023. Some properties have appreciated well over 100% in just three years. Unsurprisingly prices could not keep going at that rate in perpetuity. When Miami stopped being ‘such a deal’ many buyers unsurprisingly developed sticker shock and pulled back. Most importantly, those buyers looked at sold comps from the last 6 months and stopped being willing to pay more than the last record sale. This behavior we like to call: “the market needs a breather”. A breather doesn’t mean the market is going to correct. The market may have doubled in value over the last 3 years and the mindset of buyers is: Let’s wait for prices to come down and then I buy again. The truth is that there are a lot of buyers who are not willing to pay the current prices. The market has gone up too fast and buyers need time to process. At the same time sellers, even when they want to sell, don’t know where to go or what to buy next because they are also looking at higher prices, higher interest rates, and higher taxes. Therefore nothing is happening and some markets are seeing stand-off scenarios in many cases where deals might have other wised happen. Lots of people are therefore taking a pause, waiting for the market to come down, or as many expect, to crash. This is not true. This mindset is derived from legacy thinking and people refer to the market crash in 2007.

2. Misplaced ‘Market Crash’ Mindset

During the last peak prices were rising until 2007 and there were a lot of reasons the music stopped. The price increases were not supported by any economic fundamentals, rent was not catching up and lots of properties were purchased without any down payment. When people stopped buying, the market collapsed. Being on the ground selling real estate daily, people often tell me they are looking for deals or are waiting for the market to crash. A deal happens when someone needs to sell and therefore prices that property below market value. They have this recollection from 2007 and think if markets move up so quickly the correction should come soon. But that is not the case as today’s market is very different, and owners do not need to sell. Although the market does need a breather, the fundamentals to support a strong market are there. Most importantly inventory levels are also still relatively low compared to 2015-2020’s pre-pandemic patterns.

3. Miami has a Robust Economy

Miami’s economy is looking good! Job growth and an influx of new residents and businesses create an ongoing demand for real estate. Furthermore, the migration of business has only just begun but the new wealth and business that has permeated the city only strengthens the need for primary residences. Finally, interest rates, even though higher than in 2021/2022 are still historically pretty low and might come down in months to come.

Overview of Current Active Listings and Properties that have received a contract in the last 3 months

| HOMES | CONDOS | ||||

| Price Range | Active Listings | Pending & Active under contract | Active Listings | Pending & Active under contract | |

| $500K-1M | 431 | 206 | 2203 | 334 | |

| $1M-$3M | 330 | 114 | 1558 | 247 | |

| $3M-$5M | 209 | 44 | 391 | 52 | |

| $5M-$10M | 229 | 34 | 313 | 30 | |

| $10M+ | 224 | 25 | 138 | 10 | |

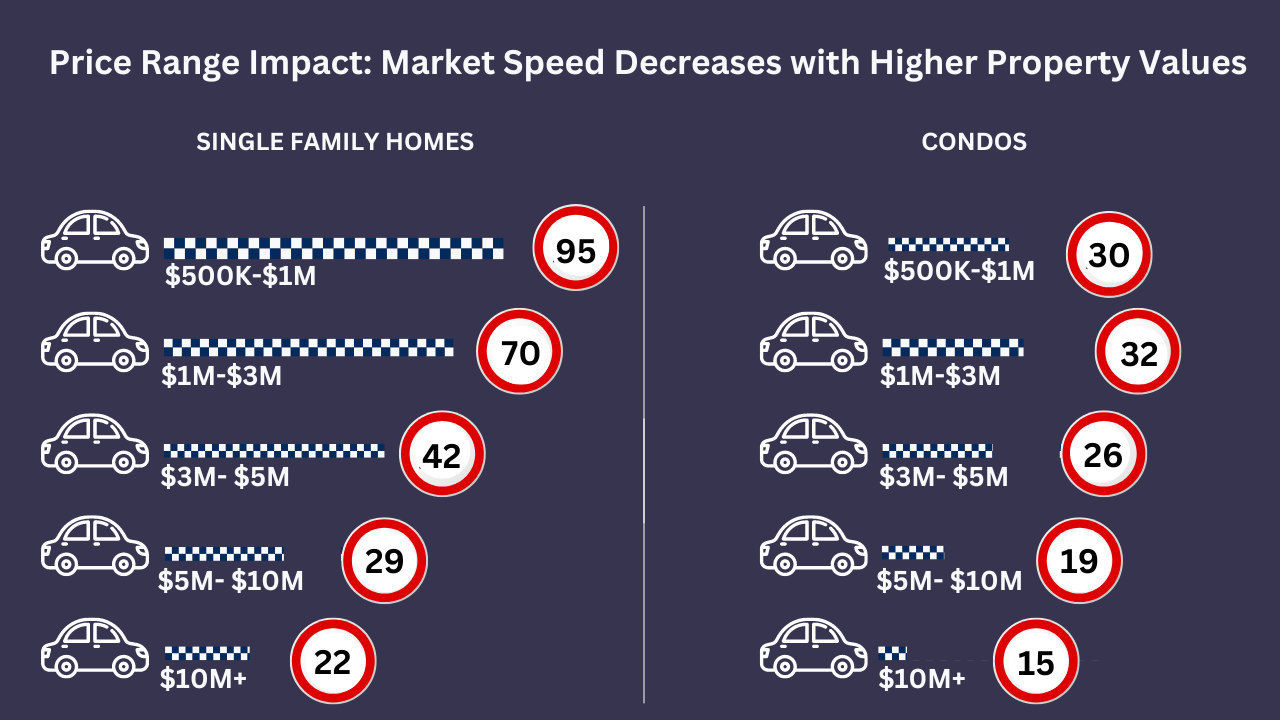

How ‘fast’ are different neighborhood markets moving in 2024?

We have found one of the best ways to explain an abstract concept like ‘Months of inventory’ or speed of sales is to put it into more relatable terms. This is especially relatable when you show the information comparably across markets. What we did below was imagine the neighborhoods were cars in a race and how fast they were moving. The faster they are moving the more sales in a set period and therefore the stronger the market’s performance.

Below we have shown the speed of sales across different price points and it is very telling! How fast your neighborhood and price point are traveling will have a huge impact on your likely success of selling. Want to get granular with your situation? As always give me a call!

$500K-$1M: Homes priced below $1 million experience the swiftest turnover as they represent the most accessible entry point for buyers. Additionally, there’s a sense of urgency among potential buyers who fear being priced out of the market and are eager to secure a home rather than continue renting. This phenomenon of being priced out is particularly prevalent in this price range and often occurs during periods of population influx, characterized by the arrival of affluent newcomers to the area.

$1M-$3M: For Single-family homes, this is still entry-level and the lack of good quality supply as well as urgency makes this price range perform well. However, the condo market in this price range experiences slower movement, with 40% of sales occurring in older buildings. This is partly influenced by interest rates, which impact affordability. Additionally, buyers in this price range may have higher expectations for condo quality and amenities relative to what is available. Furthermore, the limited availability of rental units in the housing market prompts families with children to seize buying opportunities or consider larger condos, which are in short supply. Conversely, condo buyers may have more flexibility due to the availability of rental properties, allowing them to delay purchasing decisions.

$3M-$5M: The pace of home sales slows due to the impact of interest rates on the “working wealthy”. This price range caters to a more select group of affluent individuals with exceptionally high incomes. Despite their high-paying jobs, this price range often becomes unattainable for this demographic. Conversely, it’s not typically targeted by individuals with substantial wealth seeking truly exceptional properties. The condo market experiences an even slower rate of movement in this price range, albeit with less pronounced declines. Fewer older buildings are sold here, reflecting buyer preferences for newer or more upscale options. Additionally, the occurrence of increasing maintenance costs or upcoming assessments can deter buyers at this price point, making such properties less desirable.

$5M+ Market: In the upper market segment, buyers are not compelled to make purchases; instead, they seek properties that truly captivate them. Their decisions hinge on personal preference rather than necessity. Consequently, when uncertain about market trends, they may delay their purchasing decisions. Without visible sales activity, they remain hesitant to commit. The higher you get into this price bracket the more we see a reduction in speed of sales.

For long-term buyers, the key is to identify opportune moments to secure properties at the right price. Well-priced properties continue to attract buyers, emphasizing the importance of individual property assessment rather than generalizing market trends.

Price Reductions not enough to generate more speed in Miami’s luxury Home markets.

| Percentage of Active listings that have been reduced in the last 3 months | ||

| $5M-$10M | $10M+ | |

| Coral Gables, Coconut Grove, High Pines and Ponce Davis | 28% | 28% |

| The Beaches up to Bal Harbour | 31% | 21% |

| Percentage of current listings priced higher than recent highest sale per SF. | |||

| Dry Lot Homes | Waterfront Homes | ||

| $5M-$10M | 31% | ||

| $10M+ | 50% | 66% | |

New Construction Condo Sales

We still lack a significant array of ultra-luxury condo offerings to cater to the high-end market. Sales numbers show a slow market yet the new construction sector has thrived exceptionally well. The Residences at the Mandarin Oriental, a brand new luxury offering on Brickell Key, has seen remarkable success with its condos. Despite the absence of a formal sales center, I’ve already reserved nearly 10 units, including one for myself. Within the next month, approximately half of the condo will be reserved before its official launch. This shows the appetite for exclusive and truly special projects.

Regarding pricing, different buyers respond diversely to price increases. There exists a nonlinear correlation between purchase decisions and wealth distribution. A price hike from $500 to $600 per square foot may deter buyers at the lower end of the spectrum, whereas those accustomed to prices around $2000 per square foot are less sensitive to such fluctuations, particularly if the property aligns with their preferences. Wealthier buyers acknowledge and value uniqueness, often demonstrating flexibility in budget, sometimes willing to increase it by as much as 50% for a truly exceptional property.

In the realm of new construction, prices per square foot remain substantially higher than resale values, with most properties in Brickell ranging from $1800 to $2200 per square foot, compared to resale values of $800 to $1000, maxing out at $1500.

Anticipating Shifts in the market

Currently, buyers aren’t feeling pressured to make purchases, and sellers aren’t in a rush to sell their properties either. But when will this change, and what will cause the shift? Many people are waiting for something to happen, but they can’t wait forever. After waiting for about a year, they’ll likely decide to take action. Those who are paying high rent might feel the need to act quickly. And those hoping to snag a good deal may realize that such opportunities are scarce.

There’s a lot of demand building up. We’ve been consistently showing our listings, with plenty of interest from potential buyers. However, many people are still hesitant to make a move. But there will come a time when this hesitation fades away, and people will start making decisions. That’s when we’ll see certain properties start to sell again.

Buyers of new condos aren’t too concerned about interest rates. Instead, they’re focusing on factors like population growth, business expansion, and the long-term outlook for commercial real estate. This suggests that property values will likely continue to rise over time, once we get through this quiet period.

As for triggers for change, those who aren’t feeling pressured to buy right now may start to reconsider around 2025. This could happen when interest rates decrease, elections are over or for other reasons that prompt them to take action. Once individuals grasp that prices are unlikely to see significant reductions and recognize that these prices reflect the new norm in Miami, the paradox will shift.

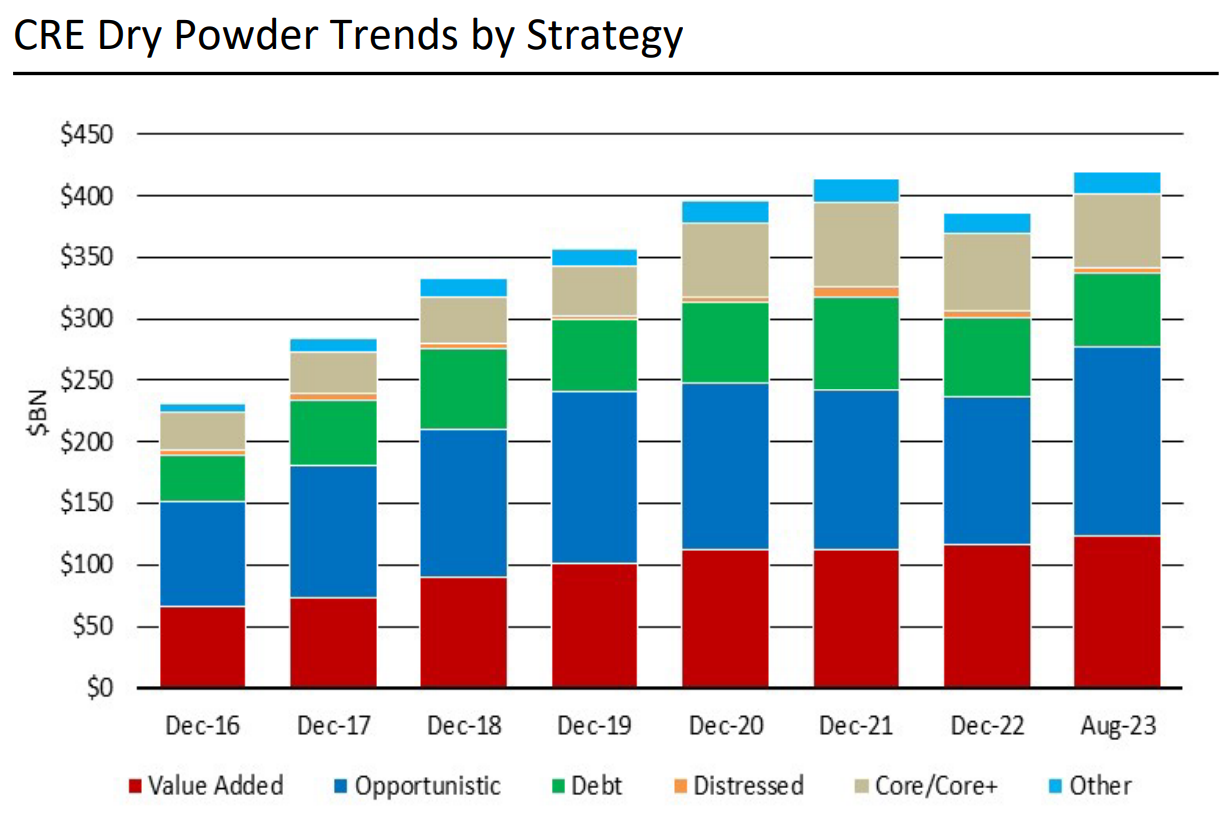

Dry Powder or Pent-Up Demand

Attached below is a graph illustrating the dry powder for commercial real estate, which closely reflects the dynamics of the residential market. It shows a high amount of people waiting with cash on the sidelines ready to catch a correction or a crash to buy. The graph indicates a significant number of individuals holding cash reserves, poised to capitalize on a potential market correction or crash. This reserve of funds is currently at an all-time high, suggesting that the market is unlikely to experience a sudden downturn. Whenever opportunities arise, these buyers swiftly enter the market, thereby stabilizing prices. In essence, the presence of these individuals waiting for a collapse acts as a deterrent to such a collapse, as their readiness to invest serves to sustain market stability.

Inflation Outlook

The Federal Reserve aims for a 2% inflation rate before considering rate reductions. Despite rising interest rates, unemployment remains remarkably low, defying expectations of a typical correlation between the two. This trend is expected to persist, with high demand for workers projected over the next decade, particularly for skilled labor. Consequently, wages are likely to increase, exerting upward pressure on inflation. Achieving the target of 2% inflation may prove challenging, potentially leading the Fed to tolerate slightly higher rates, such as 2.5%, in the future. For real estate, a significant component of inflation, this implies a greater average price appreciation over the long term compared to previous years. While real estate traditionally appreciated around 1.5% annually, now it may reach 2.5%, indicating a shift that should be factored in and taken into consideration.

The Psychology of Elections

Elections tend to stir emotions and capture people’s attention, but ultimately, regardless of the outcome, life moves forward. It’s often more of a talking point than a significant influencer of behavior. Many individuals use it as an excuse or a way to process information. However, it’s crucial to shift our reference points away from pre-COVID prices. Buyers frequently dwell on past prices and struggle to accept that prices have significantly increased since then. If prices remain high for over two years, it’s time for them to adjust their expectations and move forward. Those waiting for a market collapse should reconsider their stance; the demand is too strong, and there’s little incentive to sell with low interest rates and people who bought in cash. Even if someone decides to sell, the pool of potential buyers is currently limited. If you have a differing opinion, feel free to join our podcast and share your perspective.

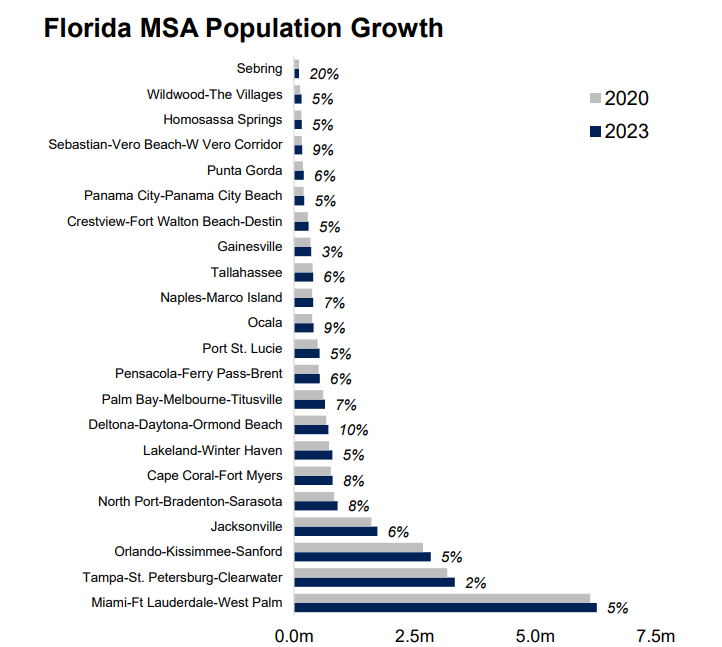

Insights into Commercial Trends and Population Expansion

The residential and commercial real estate markets exhibit distinct characteristics. In the single-family home sector, homeowners face little pressure to sell and are often inclined to retain their properties due to low mortgage rates. Conversely, in the commercial real estate realm, mortgages typically have fixed terms of 5/6 years with interest-only payments. In 2024, a significant number of these mortgages are set to expire, necessitating refinancing for affected businesses.

Refinancing may prove challenging as banks may offer lower amounts at higher rates, requiring businesses to inject additional capital or accept higher financing costs. Those unable to secure refinancing may be compelled to sell their properties, thereby increasing commercial inventory. Consequently, market softness observed in 2023 is expected to persist into 2024, with conditions likely easing thereafter due to potential interest rate decreases and fewer mortgage expirations in 2025.

In the short term, Miami’s real estate landscape will be impacted by the maturation of loans in 2023/2024. However, the long-term outlook remains promising, with expectations of substantial population growth and corresponding commercial development. While many companies have announced relocations to Miami, only a fraction have actualized these moves, with the majority pending. As these relocations unfold and commercial properties are developed, the full impact will be realized in three to four years.

Despite current luxury inventory absorption challenges, Miami’s rapid growth ensures eventual absorption, distinguishing it from other cities. The pending demand from investors and prospective residents further bolsters this outlook, underscoring Miami’s resilience in accommodating its burgeoning population and commercial expansion.

The Rental Market

The rental numbers are still strong. The market softened a little in 2023 and the numbers will stay where they are at in 2024. The demand for condo rentals has slowed down and prices leveled off, in some cases remaining stable while in others they are slightly down. It might take till 2025/2026 before we see an increase in rental prices again. New condos are coming into the market, but also we expect our population to keep growing.

For single-family homes it is different, when single-family homes are so expensive to buy or rent, some families can’t afford a home so they will look at the condo market. Families with kids, however, need a large condo with 3+ bedrooms. These are the condos in high demand, of which inventory is extremely small. These are the condos that are currently doing very well in the rental market as well. The demographic of Miami is shifting and therefore the new wave of construction is offering mostly 3 and 4-bedroom condos to cater to the new type of buyer or to investors who want to cater to the new type of renter looking for a larger condo residence.

Final Conclusions with Advice for Buyers and Sellers

Schedule a Meeting with David (Via Zoom or in Person)

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS