- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2018 Key Biscayne Luxury Real Estate Report

The 2018 Market Analysis for Key Biscayne Luxury Homes for Sale

A Softened Luxury Home Market

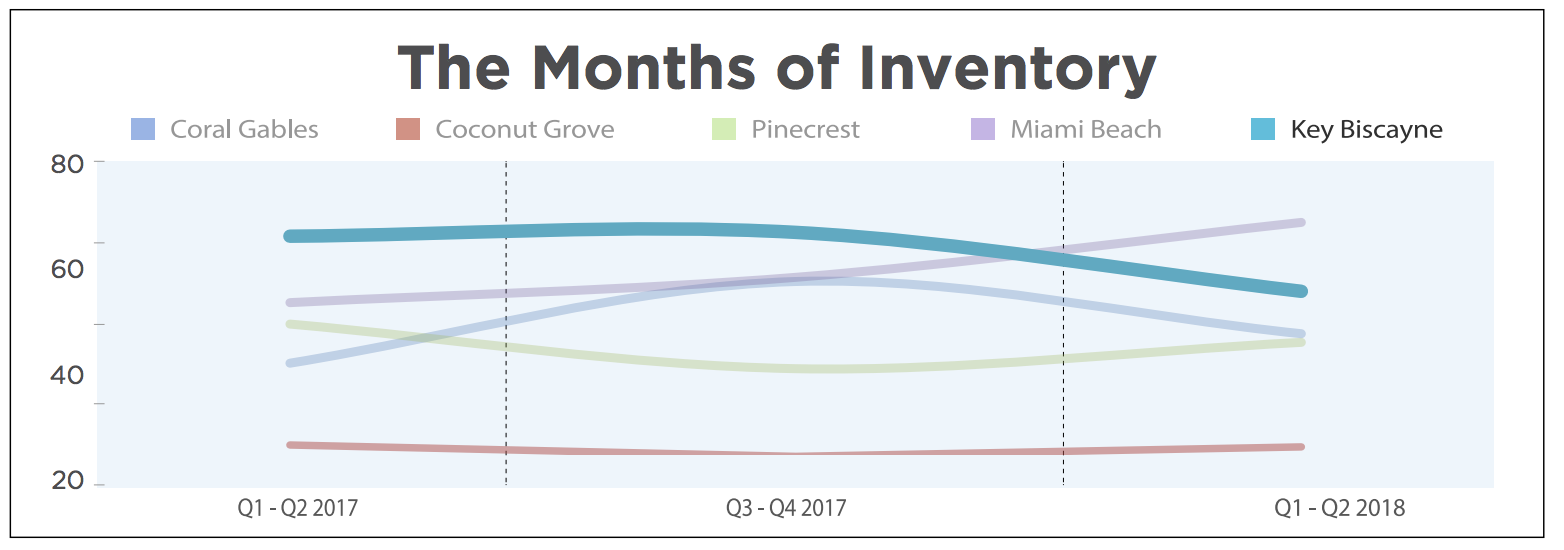

Key Biscayne luxury homes are experiencing a definitely soft market with around 50 months of inventory – not as soft as last years 60 months but still very soft. There have been just 11 sales (2 pending)so far this year, from between 1st Jan – 1st August 2018. Coming from an inventory of 64 active listings between $3m and $50m as of 1st Aug. The greatest majority (7/11) of these have been just around $3m. If we compare this to the same period last year we saw just 5 sales and 2 pending.

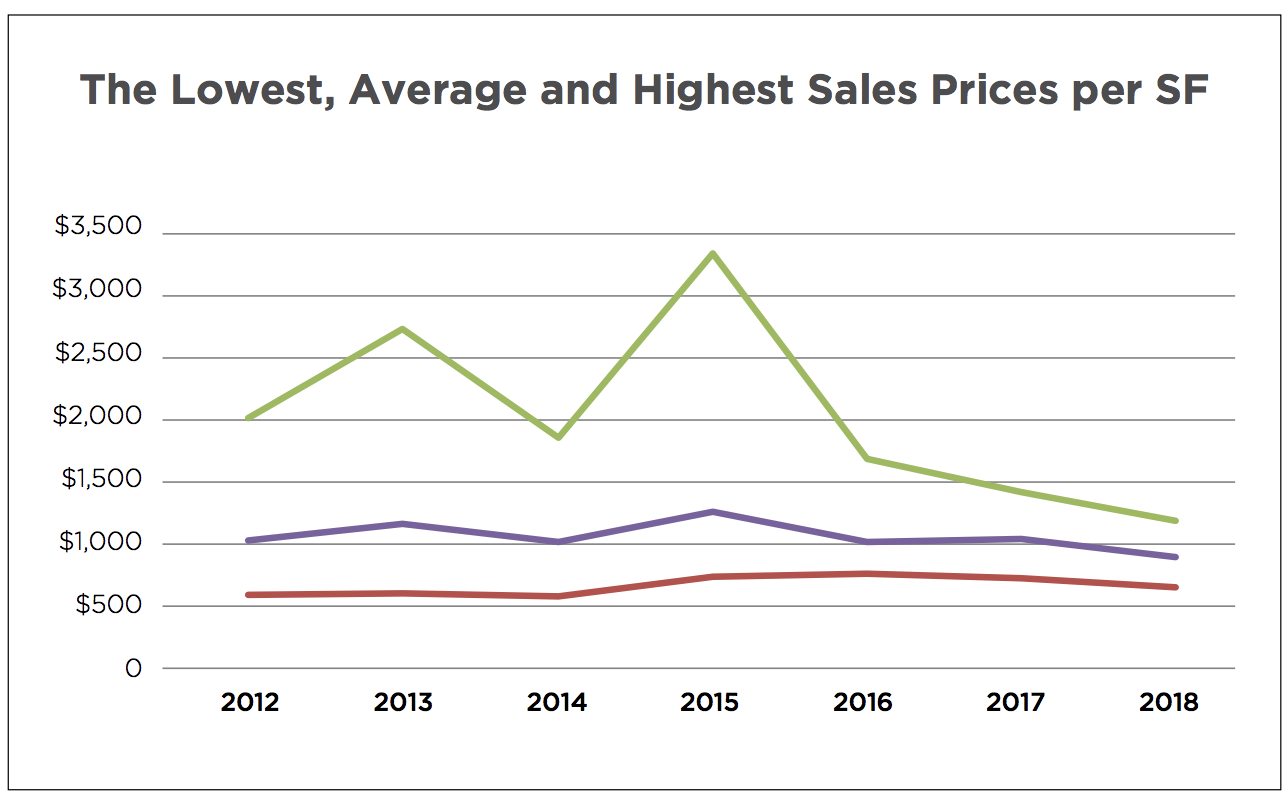

We recorded a slight decrease in average prices per SF, after several years of limited market movement. The lowest priced luxury properties (per SF) are seeing an increase in value while the highest priced properties per SF are seeing a sharp decline since 2015. Buyers are not paying the same top dollar per SF anymore, like they used to and the excess inventory and slow sales is definitely taking its toll.

Key Biscayne Vs other Luxury Neighborhoods

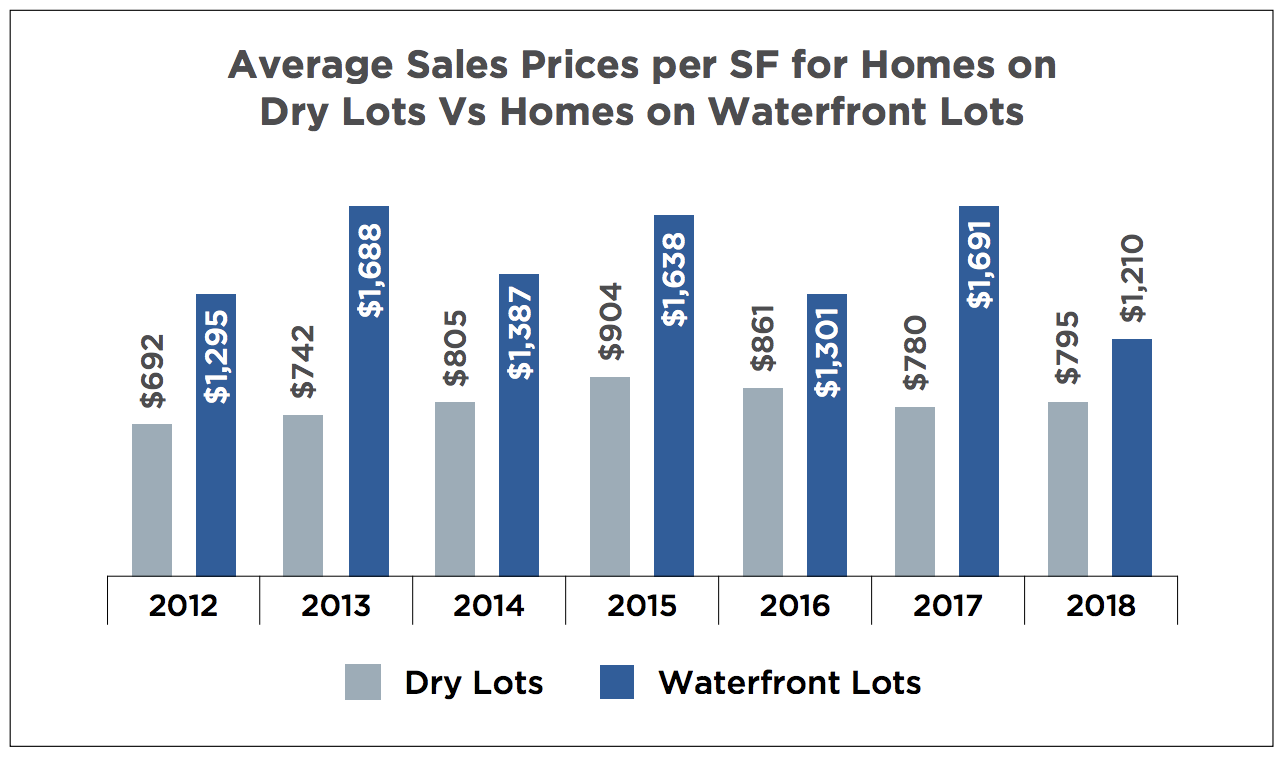

In the last few years, buyers invested in small Key Biscayne lots for massive prices per SF. Even though those lots were priced much lower in other parts of Miami, people paid the premium prices and the market spiraled almost out of control. As this market sees a lot of demand from countries that are experiencing currency difficulties, many of the buyers were drawn out of the market at the latest record prices. The Key Biscayne market offers many newer built homes that sit on a small (dry) lot and are priced between $3M and $5M. Many buyers think this is just not worth it anymore. One speculative reason for the investments made into Key Biscayne single family real estate that took the market out of sync was caused by an immigration ‘green card’ law the required certain foreign national green card holders to have to spend $450k in the local economy in order to keep their cards. The obvious and easiest solution was to spend it on their real estate and so money went on renovation improvements or new builds. Key Biscayne has long been popular with this specific category of home buyers.

Where did the buyers go is one often asked question? The answer: other luxury markets such as the Grove are now seeing more demand because they offer more value for your dollar while also offering access to top schools and are an excellent alternative at a lower cost location. When showing Key Biscayne to my buyers looking in the $3M+ market, they comment that they just don’t find the value and prefer a bigger property elsewhere in Miami. These buyers (many of which are HNWI that are relocating to Miami) are now more drawn towards the main land such as the Grove, the Gables and Pinecrest, which offer a better alternative.

I have even spoken to Key Biscayne sellers who are looking to leave the island in search for more value. They are now looking at more contemporary homes on large lots in Coral Gables and the Grove. With around 4 years of inventory we do not expect the market to recover soon. This market needs massive price corrections in order to draw back its buyers and to be able to compete with Coral Gables and Coconut Grove. When we are looking at the ultra-high end market of $10M+ homes we are seeing an entirely different situation. As this market is so limited and specific, this is a case-by-case situation. These homes are mostly located along Mashta Dr or Harbor Dr, both streets offers lots with unobstructed ocean views and are therefore rare in its kind. This kind of product is hard to find in Miami with Coral Gables only offering 42 of these lots located in Tahiti Beach and Gables Estates.

Key Biscayne Land Sales

Land Sales Key Biscayne saw one dry lot sale in 2017 and Q1 2018. This lot sold for $170 per SF or $1,275,000. There are currently 6 lots for sale ranging from $220 per SF to $530 per SF or from $1,650,000 to $7,95M. Waterfront lots start at $325 per SF or $5,8M

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS