- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

10 Types of Miami Condos You Should Never Buy

The Miami condo market has generally seen significant increases in value, making it an attractive option whether you’re looking for a place to live or an investment property. However, not all condos are created equal—some can be more trouble than they’re worth. It’s crucial to know which condos to avoid, such as those with poor investment potential, significant maintenance issues, or located in undesirable areas. Below is a guide on the types of condos in Miami you should stay away from. Remember, it’s not just about avoiding bad condos; it’s about investing in properties that appreciate in value and build your wealth. If you’d like a more detailed analysis, don’t hesitate to call me directly! You can also check out my video on the 10 Best Condos in Miami for more tips.

Please find the 10 Types of Miami Condos You Should Never Buy

1. Condos in Neighborhoods with Dropping Property Values

Why It’s a Problem: If the surrounding neighborhood is losing value, your condo’s worth is likely to decline too. This can make it difficult to sell your unit at a profit or even recover your initial investment. Buyers typically seek properties that will appreciate in value, and condos in declining areas often take the longest to sell. If your condo is priced higher than similar units in a struggling neighborhood, you may find yourself stuck with a unit that won’t appreciate.

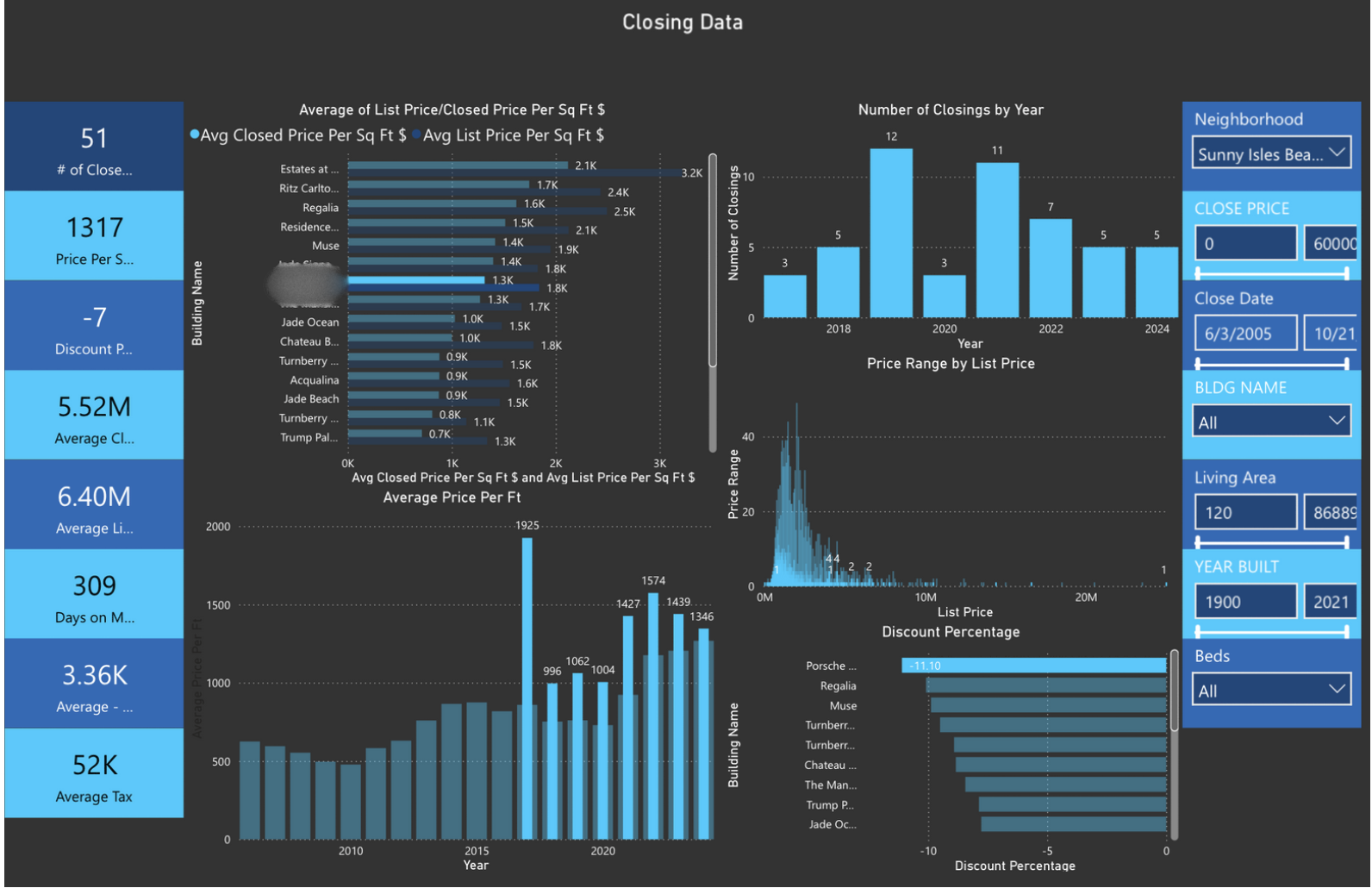

Tip: Investigate the neighborhood’s market trends and review property value history from the past few years. Steer clear of purchasing condos in areas where property values are declining, even if the condo appears to be a good deal. Our Condo Geeks software can be especially helpful for this research. Consult a local expert to find out which markets have shown consistent performance over time, as these areas are typically favored by end users and tend to experience steady appreciation.

2. Condos with Sky-High HOA Fees

Why It’s a Problem: Some buildings charge high HOA fees for good reasons, like maintaining luxury amenities or covering insurance, but others have inflated fees due to poor management or hidden costs. Even worse, these fees can go up every year, especially if the building has deferred maintenance or unexpected repairs. Over time, these rising costs can really add up, making your condo less affordable and harder to sell down the road.

Tip: Before purchasing, always request a detailed breakdown of HOA fees and review the condo association’s financial statements. Be cautious of buildings with unusually high fees or a track record of frequent increases. Also consider the age of the building as this will have a huge impact on insurance and maintenance costs.

3. Condos in Buildings with Poor Financial Health

When buying a condo, you’re not just purchasing a unit—you’re investing in the building’s overall health. Condos in buildings with poor financial management or inadequate reserves are risky, and even a beautiful unit can quickly become a headache if the association is financially unstable.

Why It’s a Problem: If a condo building has insufficient reserves for maintenance and repairs, the owners may be hit with special assessments—one-time fees to cover emergency repairs or upgrades. This could mean an unexpected bill of thousands of dollars for new elevators, roof repairs, or lobby renovations. Additionally, financially struggling buildings are less appealing to buyers and can be hard to finance, making it difficult to sell your unit in the future.

Tip: Ask for a copy of the building’s financial statements before purchasing. Look for adequate reserves and a history of responsible financial management. Avoid buildings that rely heavily on special assessments to cover basic maintenance.

4. Condos with Ongoing Litigation

Many condo buildings in Miami end up involved in legal disputes with developers, contractors, or residents. While it may seem like an external issue, buying into a building with ongoing litigation can have serious consequences for you as an owner.

Why It’s a Problem: Buildings involved in lawsuits face multiple risks. Litigation can drain a condo association’s reserves, leading to increased fees or delayed repairs. Additionally, banks may be reluctant to finance units in buildings with pending lawsuits, limiting your ability to resell the property or get financing if you ever need to refinance. If the building loses the case, the costs could be passed onto unit owners in the form of special assessments or increased HOA fees.

Tip: Before buying, always ask if the building is involved in any legal disputes. If there’s litigation pending, you may want to reconsider or thoroughly investigate the nature of the lawsuit.

5. Condos in Buildings with Frequent Short-Term Rentals

While short-term rentals like Airbnb may seem appealing, buying a condo in a building that allows frequent short-term rentals can create more problems than it solves.

Why It’s a Problem: Buildings that allow short-term rentals often experience higher wear and tear on common areas due to constant turnover. This can lead to increased maintenance costs, which will eventually be reflected in higher HOA fees for all residents. Additionally, having a revolving door of guests can reduce the sense of community, decrease security, and make the building less desirable for long-term residents or potential buyers. If you plan to live in the condo, constant vacation rental traffic can be disruptive.

Tip: Check the building’s rental policies before buying. If short-term rentals are allowed, weigh the pros and cons carefully. You may want to look for buildings with strict rental restrictions or that primarily cater to long-term residents. If the rental restrictions or too loose then this is one of the Miami Condos You Should Never Buy.

6. Condos in Older Buildings with Deferred Maintenance

Miami’s skyline is dotted with iconic condo buildings that have been around for decades. While older buildings can offer larger units and prime locations, they often come with deferred maintenance issues that can lead to costly repairs and assessments.

Why It’s a Problem: Older buildings require ongoing maintenance, and if the condo association hasn’t kept up with repairs, you could be looking at significant costs down the road. Common problems in older Miami condos include plumbing issues, roof leaks, outdated elevators, and structural wear—all of which can be expensive to fix. If these repairs have been delayed for too long, you may end up paying for them through special assessments or increased HOA fees.

Tip: If you’re considering a condo in an older building, request a detailed maintenance history and ask about any upcoming major repairs. Ensure the building has a plan (and budget) to address necessary maintenance.

7. Condos Without Adequate Hurricane Protection

Living in Miami means being prepared for hurricanes. If a condo building isn’t properly equipped with hurricane protection, you could be putting yourself—and your investment—at risk.

Why It’s a Problem: Hurricane season is a reality for Miami residents, and without impact windows, storm shutters, and reinforced roofs, condo buildings can suffer major damage during a storm. Buildings without proper hurricane protection may also face significantly higher insurance premiums, which can drive up your monthly costs. Worse, if the building is damaged during a storm, you could be looking at costly repairs or long periods of displacement while repairs are completed.

Tip: Ensure the building is up to hurricane protection standards. Look for buildings that have impact windows, storm shutters, and a history of meeting Miami’s strict building codes.

8. Condos in Buildings with Excessive Amenities

Luxury condo buildings in Miami often boast a range of amenities—pools, gyms, spas, valet parking, and even private theaters. While these features are enticing, be cautious of condos in buildings with excessive amenities that come with high costs.

Why It’s a Problem: While luxury amenities sound great in theory, they come with high maintenance costs, which are often reflected in hefty HOA fees. If you’re not using all the amenities, you could be paying for services you don’t need or want. Furthermore, over-the-top amenities can make it difficult to resell the property, especially if buyers aren’t interested in the same luxury features or can’t afford the associated fees.

Tip: Before buying, assess whether the amenities justify the cost. If the building’s amenities are excessive or rarely used, consider looking for a condo with a more practical set of features.

9. Condos with Dropping Rental Incomes

Investing in a condo for rental income can be a great way to generate passive income, but in some cases, buildings see a decline in rental returns due to increased competition or changing market conditions. Buying a condo in a building where rental rates are dropping can turn what seems like a lucrative investment into a money-losing proposition.

Why It’s a Problem: If you plan to rent out your condo, declining rental prices can significantly affect your return on investment. Buildings with a lot of rental units, especially in areas with an oversupply of rental properties, may experience decreasing rental rates as competition increases. This drop in rental income can make it harder to cover your monthly expenses, such as HOA fees, taxes, and insurance. Additionally, lower rental rates can reduce the property’s value and make it less attractive to future buyers.

Tip: Before buying, analyze the rental trends in the building and surrounding neighborhood. Look at historical data to see if rental prices are dropping, and avoid buildings where rental income is on the decline.

10. Condos with a History of Big Drops in Value

Conclusion on the 10 Types of Miami Condos to Avoid

Miami’s condo market offers endless options, but some come with hidden risks that could affect your financial stability and peace of mind. Avoid condos with sky-high HOA fees, poor financial health, ongoing litigation, frequent short-term rentals, deferred maintenance, inadequate hurricane protection, and excessive amenities. By doing your due diligence and thoroughly researching the building’s financials, maintenance history, and policies, you can protect yourself from unexpected costs and ensure your investment is a sound one.

We hope these 10 tips have helped you to know what types of condos you should avoid buying? By keeping these condo red flags in mind, you’ll be able to make smarter decisions when it comes to purchasing a condo. Avoiding these common pitfalls will help you secure a property that not only retains its value but also enhances your lifestyle. Choose wisely and invest in a condo that offers lasting benefits, not hidden headaches.

Remember, when buying a condo in Miami, it’s not just about the view or location—it’s about making a smart, informed decision that will benefit you in the long run.

Schedule a Meeting with David

If you want to know more about the nuances of the 10 Types of Miami Condos You Should Never Buy, contact me at 305.508.0899 or schedule a meeting via the calendar app below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS