- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

10 Most Googled Questions on Miami Real Estate in 2024/2025!

Let’s get into the 10 most googled questions to do with the Miami real estate market in 2024. In conjunction with this blog article you would benefit hugely from reading Part 2 and Part 3 of our Miami real estate report covering all luxury neighborhoods between Q1 and Q3 of 2024! So…. lets get into it!!

1. The Miami Real Estate Market in 2024/2025: Which markets are doing best?

High demand for luxury homes and condos in 2023 and 2024 makes this the strongest market. With that said it is the newer homes and condos in primary markets* that are selling fastest and best. The reason is that Miami’s luxury markets continue to attract high levels of interest, particularly from relocating/migrating national and international buyers. This demand is fueled by Miami’s consistent appeal as a desirable location for both investment and lifestyle (safety, schools, tax savings, and weather).

*Luxury condos and homes in the prime neighborhoods of Coconut Grove, Coral Gables, and Miami Beach remain the most highly sought-after.

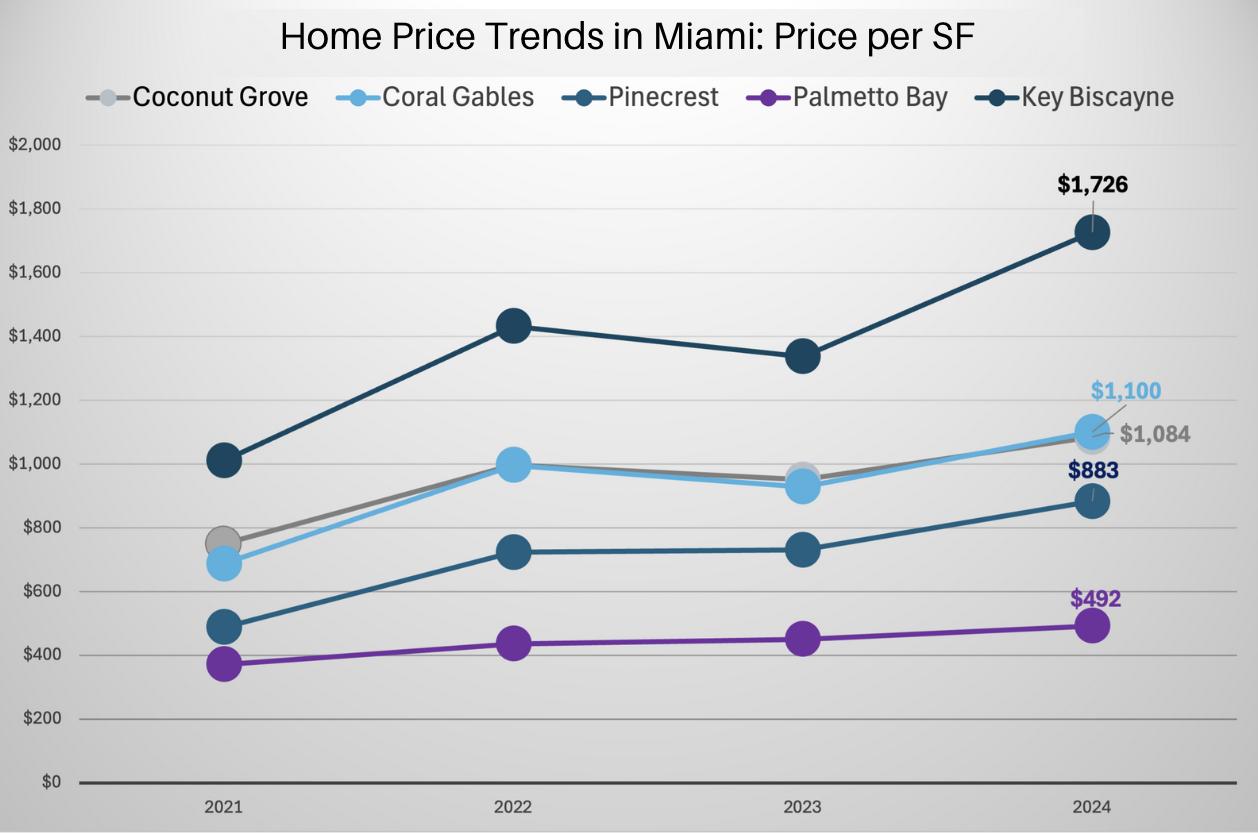

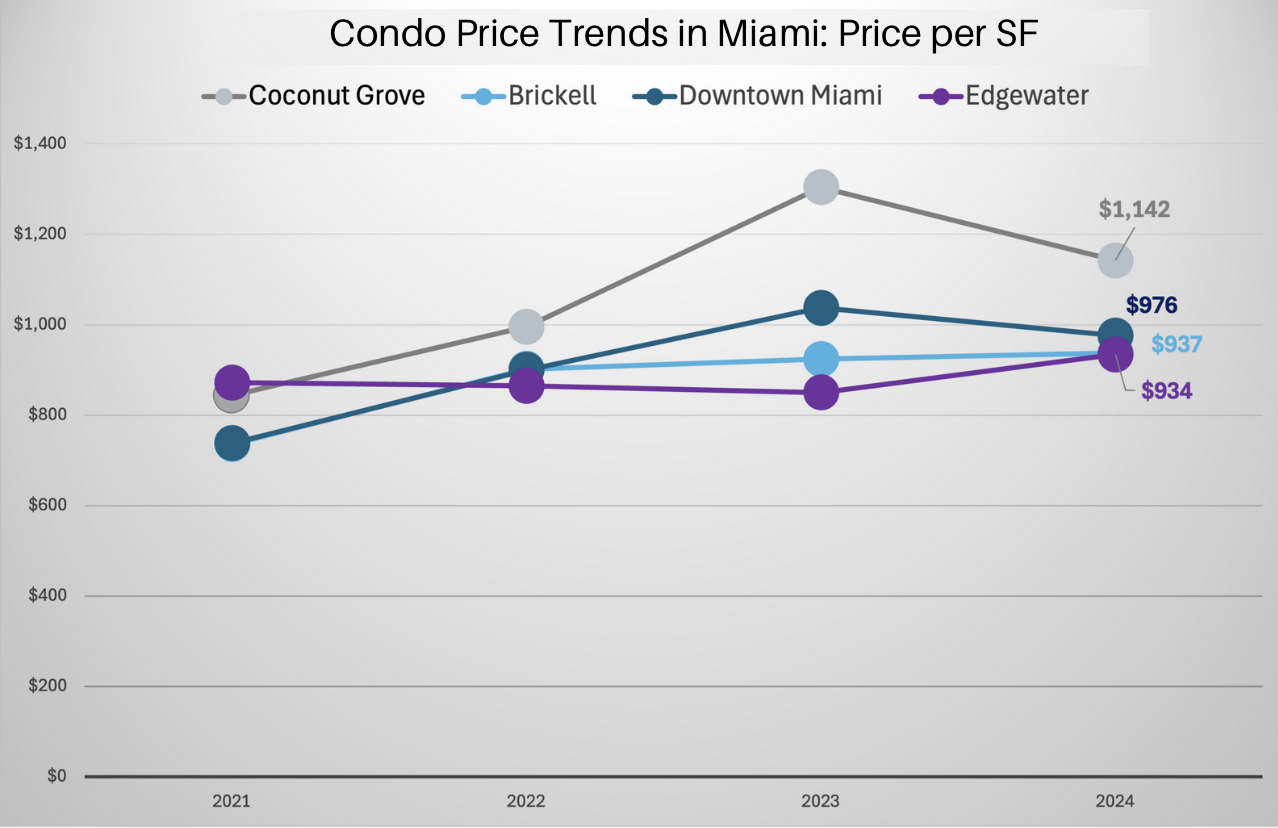

Coconut Grove and Bal Harbour’s condo markets experienced an average 5% increase in unit values. For homes, the Coconut Grove (7% increase) and Miami Beach markets (6% increase) increased the most. n 2024, the number of transactions for ultra-high-end properties priced at $10 million and above increased by 270% across major markets compared to 2023. However, the price per square foot saw only a slight increase. This is likely because prices per square foot had already reached record highs by the end of 2023, making buyers hesitant to pay even more, especially when prices are already comparable to those in high-demand markets like New York City and Los Angeles.

2. Which markets showed the largest increase in Inventory and a slower Sales Pace?

Several Miami neighborhoods experienced increased inventory and a slower sales pace. Notably, Coconut Grove and Brickell saw significant rises in available listings, with inventory levels up by around 20-38% compared to 2023. Despite what appeared to be a slowdown in sales, most markets saw properties sell much faster than a year before and inventory levels in the single-family markets remained equal. In the condo markets of Downtown and Edgewater, we did see inventory levels increase by 40 to even 60%. With that said the price per sqft and median prices actually rose.

This trend is attributed to buyer caution amidst rising prices and greater competition among sellers, reflecting a broader market adjustment across these key areas. However, what is most relevant is that the availability of quality inventory was extremely limited across many of these markets and much of the inventory that accumulated was older, of lower quality, or unreasonably priced. Those homes that did sell were desirable and the recognition of long-term growth and value means that the price per sqft figures did not suffer.

- Miami Beach Condos: Inventory increased by approximately 15% and properties stay on average 40 days longer on the market

- Surfside Condos: Reported an increase of time on the market by almost 100% (108 days compared to 58 the year before)

- Edgewater Condos saw inventory increase by 45% with a 28% longer time not the market

- Downtown condos saw inventory increase by 62.5% with

3 Is the real estate market in Miami going down?

As of 2024 the Miami real estate market is actually not going down. It is either increasing (between 3-12% depending on the neighborhood and submarket) or remaining stable. It is however giving way to some subtle market nuances which need to be understood. The extreme value increases in 2021, 2022, and even 2023 were felt across the South Florida market but none more so than the luxury sector of the market where suber-wealhty migrating professionals and families from across the country drove up prices. The luxury segment of the market, particularly for high-end condos and single-family homes in desirable neighborhoods like Miami Beach, Coconut Grove, and Coral Gables, remains strong. Prices in these areas have generally continued to rise, although the rate of appreciation has slowed compared to the rapid increases seen in previous years. I personally have experienced many sellers overreaching who are now adjusting prices. Observing reductions across these listings has led some buyers to ask me “Is this market going down because I see all these reductions going on”. My answer is that these properties are outliers which once they come in line with sold comps will in fact trade. There’s minimal evidence of corrections in sold price per square foot, with adjustments mostly seen in asking prices.

4 Are luxury rentals going down in Miami?

Typically rental rates are NOT going down in Miami. The most dominant rental market in Miami is Brickell followed by the various sections of Miami Beach and then Coconut Grove. Rental prices in Brickell have on average increased between 3-5% depending on the asset value. Coconut Grove and the Miami Beach area are much the same. With that said when we get granular there are some specific luxury buildings that have shown a drop in rental rates. Here are some examples:

- Icon Brickell – down 3%

- SLS Lux Brickell – down 4%

- Park Grove – down 4%

- Continuum – down 3%

The reasons for these drops are a combination of a building being less desirable as amenities or building conditions suffer with time and better alternatives become available. In the case of Continuum and Park Grove; seasonal shifts, market saturation, or unnaturally elevated rental rates in 2023 led to adjustments in 2024. In 2023 Coconut Grove and Park Grove received an over-abundance of relocations needing somewhere to live. In 2024 some of the tenants have shifted their preference towards purchasing rather than renting.

One of the newest and most pressing phenomenons is ‘older Condos’ with major assessments resulting in closed amenities and limited services which as a result become clearly less desirable for tenants. Who wants to live in a condo without a pool, gym, or operational terraces?

The other pressing issue that needs to be ‘watched closely’ is the cost of living in Miami of which rental rates play a big part. There has been a slight shift in renter preferences, with some renters opting for suburban areas or more affordable neighborhoods, which has slightly reduced demand in traditionally high-demand areas like Brickell and Downtown.

5. Is it a buyers or sellers market in Miami?

It’s a ‘mixed landscape’ right now. The luxury market ($3m+) particularly in neighborhoods like Miami Beach, Coconut Grove, and Coral Gables, continues to see strong demand. High-end properties, especially those with unique features like waterfront views, modern amenities, and prime locations, often attract offers quickly and comparably as high if not higher than last year’s prices. Inventory in this segment tends to be limited, giving sellers an advantage. I personally am starting to see a lot more lower quality inventory (older, ‘in need of renovation’ or overpriced) which bloats the market. This is resulting in the inventory statistics suggesting more choice for buyers than last year but this is not the whole story. The truth is that there is no more ‘good quality’ inventory, and than there was in 2023.

The mid-range market of $1m-$3m is probably the most balanced. Again, with that said the ‘good homes or condos’ fly off the shelf as there are plenty of buyers out there. Interest rates absolutely play a part here and once rates drop you can expect an injection of demand. If you are an investor this is a good market to play in right now as it could get ready for another jump. Focus on primary markets and products bought for end users. Call me for more info.

Highly dense urban areas with condo buildings that are not new or very generic. This market favors the buyer. With many similar condos on the market and new luxury condo developments arriving, the market has shifted to favor buyers. Additionally, older luxury condos outside of Brickell (but still in the urban core) and the beach, which are popular with luxury second-home buyers, have also seen a slowdown. We have seen much slower sales figures this year in St Regis in Bal Harbour, One Thousand Museum in Downtown, Elysee, and a few other luxury condos.

6. Is the Miami Real Estate Market Overpriced?

The comments of ‘Miami is overpriced’ I have heard for years. Typically from buyers who reflect on pre-pandemic prices. These buyers consistently miss the point and wait for corrections that don’t and in most cases won’t happen. The shift in price was not caused by a rush of investors but primarily by large-scale migratory end-users who moved residency to Miami. Few left, but most stayed, and the shift in not just population but population replacement (those reporting much higher earnings annually than the previous population) meant that the properties were in fact well within their financial capabilities. In luxury areas such as Miami Beach and Coconut Grove, high prices are often justified by strong demand and limited inventory. However, for those seeking more affordable housing options, Miami real estate can feel overpriced. As a result, some buyers are moving to the suburbs to find better value. However, Miami remains a robust market due to its desirability and strong demand, particularly in the luxury segment.

Ultimately, properties will and do sell at previous price per sqft levels and in a number of neighborhood price points well above. In 2024 we have seen increases in price per sqft between 3-12%. The takeaway is that ‘Quality inventory’ remains low.

With that said, there are some exceptions. Older condos undergoing major assessments can see corrections as their value to the market diminishes. The Airbnb market has become saturated and new laws restrict the profitability of these assets finally overenthusiastic ‘make me move sellers’ who price their homes or Condos above record levels and are not that well finished or well located most certainly should be viewed as overvalued. I have considerable experience in this area and can quickly help clients determine if a property is truly worth it or just overpriced by a seller.

7. Is the Miami Real Estate Market Still Booming?

There are markets in the $10m+ range that are still performing very well. These pockets focus on new homes in high-end ‘primary’ gated communities. The buying of these homes has only been tempered by the severe lack of inventory.Generally, however, Miami markets are still performing well, but the rapid growth seen in the black swan events of Covid: 2021, 2022, and the first half of 2023 has, of course, slowed. No market can naturally rise 30% year on year indefinitely! While the market remains strong, especially in luxury segments, there are signs of stabilization and modest price corrections in certain areas. Increased inventory and raised interest rates have tempered the boom, leading to a more balanced market. However, demand remains robust, particularly in desirable neighborhoods, keeping the market active but not as frenzied as before.

8 What has been a better investment in Miami in the last 5 years – A Luxury House or a Luxury Condo?

To determine whether a luxury house or condo ($,3000,000+) has been a better investment in Miami over the last five years, we can analyze the following key factors using MLS and Zillow data:

Appreciation Rates

- Luxury Houses: Historically, luxury single-family homes in Miami have seen strong appreciation, particularly in exclusive neighborhoods like Coral Gables, Coconut Grove, and Miami Beach. According to Zillow, the average price for luxury homes in these areas has increased in many cases by over 100% over the last five years!

- Luxury Condos: Luxury condos have also appreciated, but at a slightly slower pace than houses, except for larger condos in primary markets like Coconut Grove and South of Fifth which have matched the appreciation of luxury homes. In these areas, condos are in very limited supply and are often viewed as viable alternatives to single-family homes. In areas like Brickell and Downtown Miami, luxury condos have appreciated but far less than the homes or condos in the primary neighborhoods.

Rental Yields

- Luxury Houses: Historically, luxury houses have offered lower rental yields compared to condos due to higher maintenance costs and larger property sizes. However, since the pandemic spurred mass migration to South Florida, families with children and pets have increasingly preferred homes over condos, leading to a significant rise in rental yields for houses.

- Luxury Condos: Condos historically provided higher rental yields with lower carry costs but with rising HOA fees this has changed. In certain ’seasonal areas’ like South of Fifth and Miami Beach, rent yields can surpass that of homes.

Price Volatility

- Luxury Houses: Luxury houses tend to have lower price volatility, as they are often located in established, desirable neighborhoods, which are often ‘landlocked’ with no room to grow. With limited inventory plus new home inventory introduction being slow to arrive (3.5 years on average to build), homes are less volatile investments. One caveat that may be an exception to this is old homes which are undesirable for renters and slower to appreciate than newer homes.

- Luxury Condos: Condos can experience more price volatility, particularly in areas where there is a high supply of new developments.

Maintenance and Ownership Costs

- Luxury Houses: Maintenance and ownership costs for houses are typically higher due to property upkeep, landscaping, and other factors. These costs can impact the overall return on investment. Homes in floodzone areas and those on the water have also recently experienced big jumps in the cost of property insurance which significantly eats into profits.

- Luxury Condos: Condos generally are much easier to maintain and provide less headaches. They have lower maintenance costs, though homeowners association (HOA) fees can be significant, especially in luxury buildings with extensive amenities.

- Older Condos that have been poorly maintained should be avoided for investment purposes as the spiking HOA fees and assessments caused by the major landmark years of 30 years old and 40 years coupled with insurance premium hikes will eat into so much of the profits, also making these Condos undesirable and harder to sell.

CONCLUSION

- Luxury Houses: Historically, luxury houses in Miami have offered the strongest appreciation and stable long-term value, making them a solid investment for those looking for stability and capital appreciation. Most importantly newer homes in primary neighborhoods are the better investment.

- Luxury Condos: Condos have also been a good investment, particularly for those who have bought large units in and around primary markets and those more unique harder to replicate condos. Condos are less demanding and ideal for those who prefer a ‘hands-off’ approach, especially if they live far from the city and may find it challenging to address issues as they arise. However, overall the returns have been slightly lower compared to luxury houses.

These insights are based on aggregated data from MLS and Zillow. For a more personalized analysis, consider specific neighborhoods, property types, and individual investment goals.

9. Is Miami a good investment? If so; What will be the best real estate investments in the next 5 years?

I believe that long-term Miami is an absolutely amazing investment. Here are some areas and property types that are likely to offer strong investment potential over the next 5 years:

- Waterfront Properties

- Why: Waterfront homes and condos in Miami have historically appreciated well and are likely to continue doing so due to their limited supply and high demand from both domestic and international buyers. The allure of ocean views, direct beach access, and the prestige of owning a waterfront property in Miami will keep these investments strong.

- Areas: Waterfront single-family home neighborhoods: Gables Estates, Cocoplum, Old Cutler Bay, Venetian Islands, Palm and Hibiscus Islands, Sunset Islands to name a few. Waterfront luxury Condo neighborhoods with limited space: Coconut Grove, Miami Beach (particularly South of Fifth), Fisher Island, and Key Biscayne.

- New Developments in Emerging Neighborhoods

- Why: Emerging neighborhoods that are undergoing significant development and revitalization often see substantial appreciation as they become more desirable. Investing in luxury properties in these areas early can yield high returns as the neighborhoods mature.

- Areas: Edgewater, Wynwood, Glenvar Heights, Shenandoah, and Allapattah. These areas are seeing a surge in new luxury developments, including high-rise condos and mixed-use projects that blend residential, retail, and cultural spaces. With that said avoid generic replicable products. There is still much space in areas of Edgewater and new Condos can be regularly introduced.

- Luxury Condos and New Development Condos in and around the Urban Cores

- Why: Miami’s urban core areas like Brickell and Downtown continue to be magnets for professionals and international buyers. Luxury condos in these areas are in current short supply. They offer high rental yields and strong appreciation potential, especially as the city invests in infrastructure and major corporate relocations like ‘Citadel’ bring about an abundantly wealthy workforce looking for new residences and rentals.

- Areas: Brickell, Downtown Miami, and Coconut Grove.

- Examples of these Condos: Mandarin Oriental, 1428 Brickell, St Regis, Four Seasons Brickell, Park Grove Coconut Grove, Four Seasons Coconut Grove.

- Ultra-Luxury Market in Exclusive Neighborhoods

- Why: The ultra-luxury segment, which includes properties priced at $10 million and above, has shown resilience and a significantly increased number of transactions in 2024. These properties are often located in highly exclusive neighborhoods and offer unparalleled amenities, privacy, and prestige with an extremely limited supply chain.

- Areas: Fisher Island, Star Island, and Coral Gables (Gables Estates, Cocoplum, The Moorings). Ponce Davis, Snapper Creek, and Hammock Lakes.

- Eco-Friendly and Smart Homes

- Why: As sustainability becomes increasingly important, luxury homes with eco-friendly features and smart technology integration are likely to see growing demand. These properties not only appeal to environmentally conscious buyers but also offer long-term savings on energy costs.

- Areas: Coconut Grove, Coral Gables, and newly developed areas where builders are focusing on sustainable luxury. We are working with a current owner who is installing the first Tesla roof in Miami!

- Private Estates with Large Lots

- Why: Post-pandemic, there’s been an increased demand for larger homes with more outdoor space. Private estates that offer extensive grounds, privacy, and the ability to customize living spaces will continue to be in demand, particularly among affluent buyers seeking a retreat-like environment.

- Areas: Pinecrest, Ponce-Davis, and Southwest Ranches.

- Luxury Rentals and Investment Properties

- Why: The demand for luxury rentals, particularly in short-term rental markets, is likely to remain strong. Properties that cater to this market, offering top-tier amenities and prime locations, will be attractive to investors looking for strong rental yields.

- Areas: South Beach, Brickell, and Wynwood.

Investment Strategies:

- Early Entry: Invest early in emerging neighborhoods or new developments to capitalize on appreciation as the areas develop.

- Focus on Unique Properties: Look for properties with unique features, such as waterfront access or cutting-edge sustainability, which tend to hold their value better.

- Diversification: Consider diversifying across different types of luxury properties (e.g., condos, single-family homes, and estates) to mitigate risk.

CONCLUSION

The best luxury residential real estate investments in Miami over the next five years are likely to be in waterfront properties, new developments in emerging neighborhoods, luxury condos in urban cores, and ultra-luxury estates in exclusive areas. Properties with eco-friendly features and smart home technology are also expected to be strong performers as demand for sustainable luxury grows. By focusing on these areas and property types, investors can position themselves for strong returns in the evolving Miami real estate market.

10. What is the outlook for Miami real estate in 2025?

Our outlook for the luxury Miami real estate market in 2025 is optimistic, with several factors influencing its trajectory:

- Continued Demand from Domestic and International Buyers

- Strong Interest: Miami’s luxury market is expected to continue attracting high-net-worth individuals from acrossthe U.S. and internationally. The city’s favorable tax environment, desirable climate, and lifestyle offerings make it a prime destination for luxury buyers, particularly those from states with higher taxes and colder climates, as well as from Latin America and Europe.

- Supply Constraints

- Limited Inventory: While new developments are underway, the supply of ultra-luxury properties (particularly single-family homes and waterfront estates) remains limited. This supply constraint is likely to support price stability or growth, especially in the most sought-after neighborhoods.

- New Developments: High-end condos and mixed-use developments in areas like Edgewater, Brickell, and Downtown will add to the inventory, but prime waterfront homes and estates will remain scarce.

- Economic and Political Stability

- Economic Factors: The broader economic environment, including interest rates and inflation, will play a significant role. We at DSG expect the interest rates to drop by 0.5% in September and again in December. This will inject a good number of both buyers and sellers back into the mid-range luxury home markets of $3-$5m. However, the ultra-luxury segment tends to be less sensitive to interest rate changes. Regardless, this market will stay strong.

- Political Environment: Miami’s luxury market could benefit from continued political and economic instability in other parts of the world, driving foreign investment into the U.S. real estate market, particularly in safe-haven cities like Miami.

- Sustainability and Climate Change Considerations

- Rising Awareness: Buyers are increasingly factoring in climate change and insurance premiums when making real estate decisions. Miami’s vulnerability to the changing insurance market monopolitically controlled by Citizens Insurance could influence where and what type of luxury properties are in demand. However, properties designed with sustainability, resilience, and dry lot homes away from the flood zone will see increased demand.

- Price Stabilization and Potential Growth

- Market Stabilization: After the rapid price appreciation seen in recent years, the luxury market may experience more stable growth. Prices are expected to hold steady, with modest appreciation in the most desirable areas.

- Opportunities for Growth: Areas undergoing significant development or revitalization, such as Wynwood and Edgewater, may offer stronger appreciation potential as these neighborhoods mature and attract more luxury buyers, as well as areas that cater to those being pushed out by the wealthier migrating higher-earning buyers and renters.

CONCLUSION

The luxury Miami real estate market in 2025 is expected to remain strong, with continued demand from both domestic and international buyers. While the market may see more stable price growth compared to the explosive increases of the past few years, the overall outlook is positive. Key factors such as limited inventory, the ongoing appeal of Miami as a luxury destination, and the integration of sustainability and technology into luxury properties will continue to drive the market. Buyers and investors should focus on prime locations, properties with unique features, and emerging areas with strong growth potential to capitalize on the opportunities in the Miami luxury market. They should stay away from older Condos with ballooning HOA fees and properties at a higher risk of flood and insurance costs.

Schedule Time with David (Via Zoom, Call or in Person)

Schedule time to discuss your personal questions regarding the Miami Real Estate Market in 2024/2025

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS