- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Advantages of Real Estate Investment Funds

In this “Better Decisions” podcast episode, I engaged in a conversation with Dylan Fonseca from Centro, a commercial real estate fund headquartered in Miami. As dedicated owners and operators, they specialize in the acquisition and management of real estate assets that generate cash flow, all within the framework of a carefully structured fund. With a commitment to long-term ownership, Centro concentrates its efforts on commercial shopping centers and multifamily properties. As a caveat thus fund and therefor this podcast is only good for accredited investors.

We delve into Centro’s approach, exploring their strategies for identifying lucrative investment opportunities and maximizing returns. Whether you’re a seasoned investor or new to the world of real estate, join us as we uncover valuable insights and investment advice that could shape your financial future. What surprised myself was the high yield some of these funds are returning. Even in todays market we are seeing annual returns between 7-9% with a further appreciation of the asset of 50% or more. When averaging this out it is bring about returns of as much as 20% year on year for the duration of a 7 year fund.

Differing from traditional real estate investment discussions, our podcast aims to keep you informed about fresh and valuable investment insights.

Real Estate Investment Funds | Unveiling the Enigma

Why is there a lack of awareness surrounding these real estate funds? The reason lies in their relative unfamiliarity. Unlike individual real estate purchases or investments, which are more common, real estate funds operate within a more complex domain. Accessing these funds typically requires a good amount of capital and know-how to understand how they work. Consequently, they remain largely inaccessible to the general public. Essentially, these funds function as collective ventures wherein individuals pool their resources to acquire assets such as shopping centers or multi-family buildings. Given the high price points associated with these assets, participation in such funds tends to be exclusive.

How Does a Commercial Real Estate Fund Work?

Centro specializes in mid-sized assets valued between $15-50 million. In this way, he occupies a special position where he doesn’t compete with big institutions investing billions of dollars, nor does he compete with individual investors. He’s squarely in a niche and seeks higher returns within that range. Usually, a fund lasts for about 7 years and can be split into three stages: a period for gathering investors and assets, a phase for managing investments, and a period for selling assets as the fund grows older.

If you invest $1 million in Centro’s real estate fund, you commit to this fund for a value of $1M. You sign the agreements and pay an initial deposit into the fund’s escrow account. Funds are drawn gradually as needed, with investors contributing according to their commitment. For example, if the fund buys an asset that is worth 10% of the total fund amount, then the asset manager will ask you for 10% of what you committed to. During deployment periods, the fund strategically acquires deals after assessing the market to pinpoint the best investment strategies, ensuring a balance between risk and return. Once acquisitions are complete, the operational phase begins, generating monthly returns for investors. The lifecycle of a fund is around 7 to 8 years, and during this period the investment matures. The commercial lease might be increased leading to higher returns on investment. At the end of the investment cycle, the harvesting period commences, which means the fund will be selling the assets as they have reached the end of the fund life.

With usual fund sizes hovering around $150 million and consisting of roughly 47 to 50 investors, Centro also manages funds with smaller groups of 15 to 25 investors. Generally, funds prefer investors who can commit at least $1 million.

Anticipated Returns of Centro’s Commercial Real Estate Investment Funds

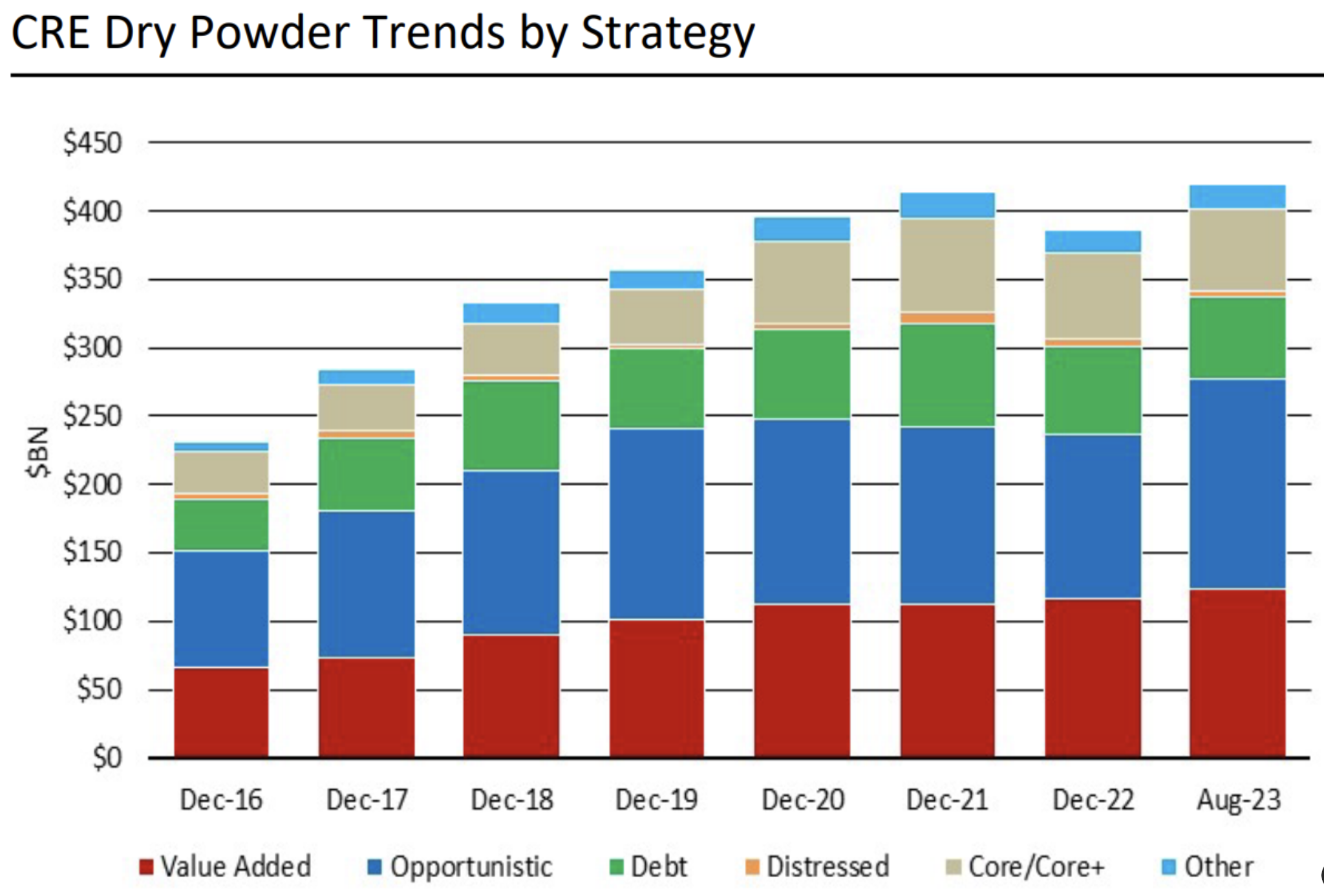

Dry Powder or Pent-up demand from investors waiting to get into Commercial Real Estate

How do you Define the Ownership in the Real Estate Fund?

When you invest in the fund, you’re essentially owning a portion of the company. There are two important documents you’ll sign: the Operating Agreement and the Subscription Agreement.

- The Operating Agreement outlines the rules of the company, including how decisions are made and how the company is managed.

- The Subscription Agreement details how your money is handled and specifies what you’re buying and what percentage of the company you own.

Determining Real Estate Investment Choices

So, who decides which assets the fund invests in? That responsibility falls on asset managers such as Dylan. But how do you, as a real estate investor, stay informed about these investments? Do you pitch ideas or simply receive explanations? Centro has specific investment criteria; for example, they might target shopping centers in the southeast anchored by national companies like Whole Foods. They look at high-traffic areas, with the right demographic and the right type of commercial tenants. There are many shopping centers or malls in South Florida, but not all are high performers. Centro specializes in finding cash cows. However, acquiring such assets requires expertise and entails risks. Sellers may not take you seriously unless you’re well-prepared and credible.

Centro occupies a unique position in the market—not too small, not too large—which allows them to access a lot of promising deals. With over 20 years of experience and a background in managing assets worth billions, Dylan and his team have established relationships with key players in the industry. They’re well-known among brokers and have earned respect within the industry, giving them an edge when it comes to making deals.

Leveraging Data for Informed Investment Decisions

Retail is currently experiencing a surge, with major players entering the market, making it an attractive prospect for landlords. We’re witnessing a shift where retail presents high returns with relatively low risk, making it an opportune time to invest in this sector. But how does Centro decipher this trend? Their approach is data-centric; they leverage vast datasets that others may not have access to, providing them with valuable insights. This advantage allows them to make informed decisions and uncover opportunities that others might overlook. For instance, Centro analyzes various data points such as cell phone data to understand (foot) traffic trends, comparing the performance of different retail outlets like Whole Foods. By examining what factors contribute to the success of certain locations, they can identify patterns and determine the ideal locations for new projects.

Ultimately, Centro’s goal is to secure tenants who have the potential to thrive and demonstrate to them how they can succeed. Their success is crucial to the funds, and their research-driven approach ensures that they make strategic decisions to benefit both parties.

What are the Risks Involved?

Speaking of risk, it’s relatively lower compared to other sectors. In the fund’s model, the fund owns the land and constructs the building. After it is leased, the tenants are responsible for maintaining the properties they occupy, known as net leases, Unlike in other asset classes where the owner bears these costs (gross leases). In addition, costs like insurance are also borne by the tenant. It is of course in the interest of Centro to keep these costs down to be more attractive to these potential tenants.

Commercial Real Estate Investment Funds in 2024 and Beyond

Retail has always relied heavily on location for survival. Shopping centers, being among the most strategically positioned assets, benefit from high accessibility and convenience. Centro focuses on acquiring retail spaces in prime locations along major highways and intersections, ensuring a constant flow of traffic and the right demographic profile. Whether it’s a grocery store, medical facility, or pet shop, businesses thrive due to their placement, making these investments highly resilient.

Furthermore, Centro considers prospects. For instance, if a mall occupies a prime spot, can we explore additional developments such as residential apartments? Or if it’s adjacent to a hospital, will that hospital need to expand somewhere in the future? Centro’s investments provide dual revenue streams—through land ownership and lease income—ensuring financial stability and potential growth over time.

Exploring Retail’s Current Dominance: What’s Driving its Success?

In South Florida, retail is outperforming other commercial sectors despite a history of overbuilding. While there’s currently an oversupply of properties, buyers are gravitating towards high-quality retail spaces, especially in prime locations where new construction is rare. This limited new supply prevents a significant softening in the market. In contrast to industrial and multifamily sectors, there’s less new supply in retail, giving landlords of quality malls a competitive edge.

The Effect of Rising Interest Rates

However, recent market dynamics have been influenced by rising interest rates, impacting transaction volumes. Buyers are cautious about financing projects with higher interest rates, affecting the perceived value of properties. At the same time, sellers did not want to lower the prices, This is the same paradigm we have seen in the residential market where we see a standoff between sellers and buyers. Yet, there’s a positive shift as sellers become more realistic in their expectations, leading to a healthier, more balanced market. Funds that are expiring this year will therefore see less appreciation than those experienced in the previous year. Although appreciation was lower, the income was compensated with the high yield achieved in recent years. Sellers becoming more realistic, together with several REITS selling off assets will lead to increased deal flow and a healthier market.

Why Sell a High-Yield Asset?

Why consider selling assets that generate 7-8% returns if you’re already earning good interest, and why isn’t everyone purchasing them? The typical approach is to acquire a property and hold onto it for several years. Market timing isn’t always perfect; you buy when it’s not yet matured but appreciating, and then sell when the time is right. Asset managers of large insinuation do not look at every individual asset. They focus more on achieving high returns in a certain period. Therefore when the lifecycle ends they sell the assets no matter how it performs. For many investors, a more tailor-made approach in which every asset is evaluated at the end of the proposed lifestyle would be beneficial. Centro’s business size allows them to engage with investors and tailor their decisions accordingly. Unlike massive asset managers tied to pension funds, Dylan’s funds have the flexibility to adapt to market conditions. Middle-ground investors like Dylan can make more personalized decisions, thanks to the manageable size of their investor base.

If some people want out and others don’t

If an investor decides to exit before the end date, we assist in finding someone willing to acquire their shares. There isn’t a set valuation, so departing investors leave with their original share of the investment whether it’s appreciated or depreciated. Typically, nine out of ten investors within the group will purchase the departing investor’s shares.

Making Informed Investment Decisions in the Real Estate Market

Often, individuals ask the wrong questions when navigating the real estate landscape. While there may be an abundance of condos on the market, finding large condos with 4 bedrooms and 3,000 SF+ can be challenging. It’s crucial to ask the right questions and scrutinize the unique aspects of each property. Not all retail spaces are created equal, and discerning investors like Dylan focus on selective properties with high-performance potential. While high yields may seem attractive, it’s essential to evaluate whether the extra percentage points justify the investment. Assessing the individuals behind the deal is equally critical. Do they possess the necessary skills and experience to execute the strategy effectively? Understanding the background, qualifications, and business plan of the team involved is paramount for success. In the dynamic Florida market, it’s easy to be swayed by trends or recommendations from friends. However, investing in easily replaceable assets may not yield long-term benefits. Consider the durability of the investment over time, especially when the initial allure fades. While perfection is elusive, thorough research and effective communication can mitigate risks. Unforeseen events like the COVID-19 pandemic underscore the importance of adaptability and clear communication from investment partners. Ultimately, strive for well-informed investment decisions guided by a comprehensive understanding of the market dynamics.

Conclusions

In the world of real estate investment, Centro stands out for its focused and strategic approach, offering investors unparalleled opportunities for growth and stability.

- Focused Investment Approach: Centro directs its efforts towards commercial shopping centers, recognizing them as lucrative assets with consistent returns.

- Long-Term Ownership Strategy: At Centro, commitment to long-term ownership is not just a strategy; it’s a promise of stability and sustained growth over time, ensuring investors reap the rewards of patient investment.

- Exclusive Investment Opportunities: Centro opens doors to exclusive investment opportunities typically inaccessible to individual investors, providing a gateway to a world of high-value assets.

- High-Performing Assets: Specializing in mid-sized assets valued between $15-50 million, Centro strategically targets high-profit areas, maximizing returns for its investors.

- Data-Driven Decision Making: Leveraging cutting-edge technology and extensive datasets, Centro employs a data-driven approach to identify and capitalize on lucrative investment opportunities, ensuring informed decisions at every step.

- Flexible Investment Structure: Centro offers investors the flexibility to tailor their investment decisions according to their preferences and market conditions, providing a personalized approach to wealth creation.

- Diverse Revenue Streams: Investments in prime retail locations under Centro’s guidance offer investors dual revenue streams through land ownership and lease income, guaranteeing financial stability and long-term growth potential.

- High Returns with Low Risk: Centro’s funds deliver impressive potential dividends of 7-8% annually, coupled with the possibility of further appreciation over time, making them a compelling choice for investors seeking attractive returns with minimized risk.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS