- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

10 Types of Fort Lauderdale Condos You Should Never Buy

Please find the 10 Types of Fort Lauderdale Condos You Should Avoid!

1. Condos in Neighborhoods with Declining Property Values

Buying in a neighborhood where property values are decreasing can lead to losses when it comes time to sell. In Fort Lauderdale, some areas may see drops in demand due to factors like economic changes, overbuilding, or unpopular developments—often in investor-heavy neighborhoods.

Why It’s a Concern: When property values in the area are falling, your condo’s value is likely to follow suit. This can make it challenging to sell your unit for a profit or even recoup your initial investment. Buyers usually look for properties with appreciation potential, and condos in declining areas can take longer to sell. If priced above similar units in these neighborhoods, your condo may struggle to gain value over time.

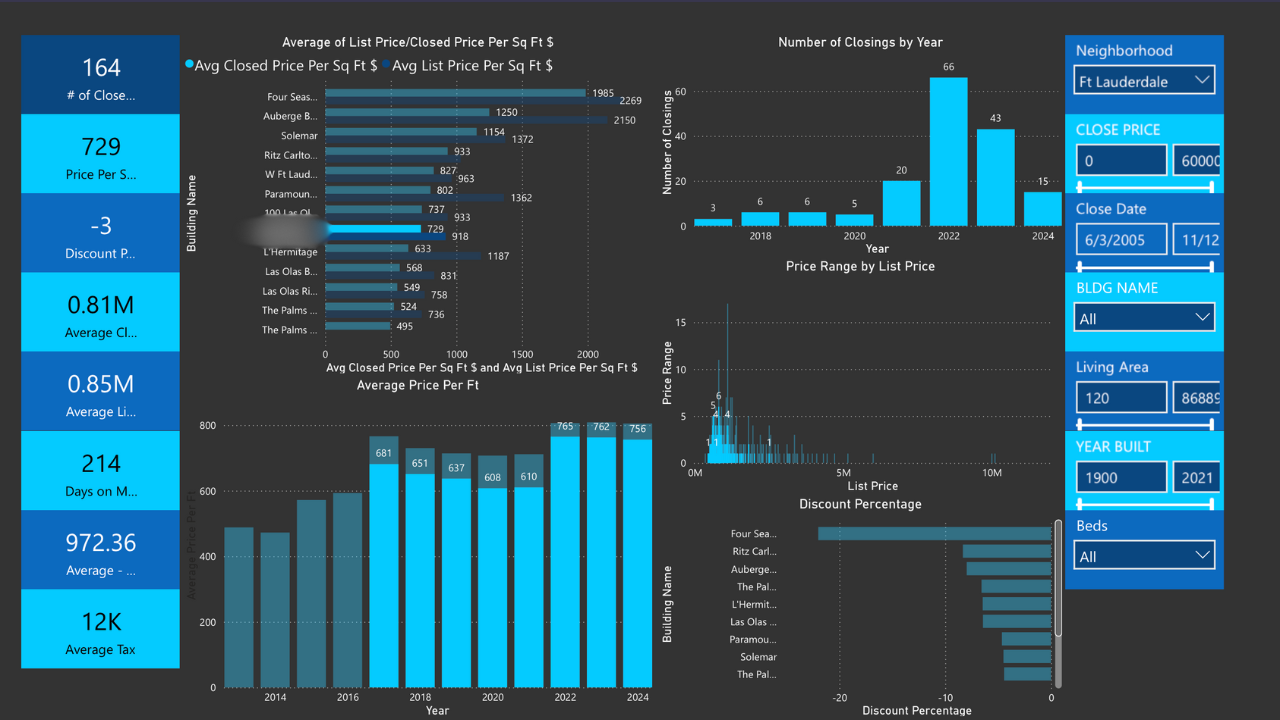

Tip: Research neighborhood trends and review property values over recent years. Avoid buying in areas with a history of declining values, even if the condo seems like a bargain. Our Condo Geeks software is a valuable resource for this research. Consult a local expert to identify areas with steady, long-term performance, as these markets are often favored by end users and tend to see stable appreciation.

2. Condos with Excessive HOA Fees

While condo living provides shared amenities like pools, gyms, and common areas, these come with homeowners’ association (HOA) fees. In some Fort Lauderdale buildings, these fees can be exceptionally high (or may suddenly increase), making ownership more expensive than anticipated. With rising insurance costs and the shift from 40-year to 25-year building recertifications, it’s important to factor HOA fees into your decision.

Why It’s a Concern: Some buildings have high HOA fees for valid reasons, like maintaining premium amenities or covering insurance, while others have inflated fees due to mismanagement or hidden costs. Even more concerning, fees can increase annually, especially if the building faces deferred maintenance or surprise repairs. These escalating costs can add up over time, making your condo less affordable and potentially harder to sell in the future.

Tip: Before buying, request a detailed breakdown of HOA fees and review the condo association’s financial statements. Be wary of buildings with unusually high fees or a history of frequent increases. Consider the building’s age, as this significantly impacts insurance and maintenance expenses.

3. Condos in Buildings with Financial Instability

When you buy a condo, you’re also investing in the financial health of the building. Condos in buildings with poor financial management or insufficient reserves can be risky, as even a well-maintained unit can become a burden if the association is financially unstable.

Why It’s a Concern: Buildings lacking adequate reserves for maintenance and repairs may impose special assessments—unexpected fees for urgent repairs or upgrades. This could mean a surprise bill of thousands of dollars for new elevators, roof repairs, or lobby renovations. Additionally, financially troubled buildings are less attractive to buyers and may be difficult to finance, which can hinder the resale of your unit.

Tip: Request the building’s financial statements before making a purchase. Look for strong reserves and a history of prudent financial management. Be cautious of buildings that frequently rely on special assessments to cover basic upkeep.

4. Condos with Active Litigation

5. Condos in Buildings Permitting Frequent Short-Term Rentals

While short-term rentals like Airbnb may seem attractive, buying a condo in a building that allows frequent rentals can lead to more issues than benefits.

Why It’s a Concern: Buildings with frequent short-term rentals often see increased wear on common areas due to constant tenant turnover, resulting in higher maintenance costs and, eventually, higher HOA fees for residents. The steady flow of guests can also diminish community feel, reduce security, and make the building less appealing to long-term residents or buyers. If you plan to live in the condo, ongoing vacation rental activity may also be disruptive.

Tip: Review the building’s rental policies before purchasing. If short-term rentals are permitted, weigh the pros and cons. Consider buildings with strict rental limitations or those catering primarily to long-term residents. Buildings with overly lenient rental policies may be among the Fort Lauderdale condos you’ll want to avoid.

6. Condos in Older Buildings with Deferred Maintenance

Fort Lauderdale’s skyline includes many iconic condo buildings with decades of history. While these older buildings may offer spacious units and prime locations, they often come with deferred maintenance issues that can result in costly repairs and assessments.

Why It’s a Concern: Older buildings require consistent upkeep, and if the condo association has fallen behind on necessary repairs, you could face substantial costs in the future. Common issues in older Fort Lauderdale condos include plumbing problems, roof leaks, outdated elevators, and structural wear—all of which can be costly to address. Prolonged delays in these repairs may result in special assessments or higher HOA fees for residents.

Tip: If you’re considering a condo in an older building, request a comprehensive maintenance history and inquire about any major repairs on the horizon. Confirm that the building has a maintenance plan and budget in place.

7. Condos Lacking Proper Hurricane Protection

Living in Fort Lauderdale means being ready for hurricane season. If a condo building isn’t adequately equipped with hurricane protection, you risk both your safety and your investment.

Why It’s a Concern: Hurricane season is an unavoidable part of life in Ft. Lauderdale. Without impact windows, storm shutters, and reinforced roofs, condo buildings are vulnerable to significant damage during storms. Buildings lacking proper protection may also face much higher insurance premiums, raising your monthly costs. In the event of storm damage, you could be faced with expensive repairs or long periods of displacement while the building is fixed.

Tip: Verify that the building meets hurricane protection standards. Look for properties with impact windows, storm shutters, and a track record of complying with Ft Lauderdale’s strict building codes.

8. Condos in Buildings with Over-the-Top Amenities

Luxury condo buildings in Fort Lauderdale often feature an array of amenities—pools, gyms, spas, valet parking, and even private theaters. While these perks may be appealing, be cautious of condos in buildings with excessive amenities that come with high costs.

Why It’s a Concern: While luxury amenities are attractive, they come with substantial maintenance costs, often reflected in high HOA fees. If you don’t use all the amenities, you might end up paying for services you neither need nor want. Additionally, extravagant amenities can make it harder to resell the property, especially if prospective buyers aren’t interested in or able to afford the associated costs.

Tip: Before purchasing, consider whether the amenities justify the price. If the building offers excessive or rarely used features, it may be worth seeking out a condo with a more practical selection of amenities.

9. Condos with Declining Rental Income

Investing in a condo for rental income can be a smart way to generate passive income, but some buildings experience a decline in rental returns due to increased competition or changing market conditions. Purchasing a condo in a building with falling rental rates can turn a promising investment into a financial loss.

Why It’s a Concern: If you plan to rent out your condo, declining rental prices can significantly impact your return on investment. Buildings with many rental units, especially in areas with an oversupply of rental properties, may face decreasing rental rates as competition grows. Lower rental income can make it difficult to cover monthly costs, such as HOA fees, taxes, and insurance. Furthermore, reduced rental rates can lower the property’s value and make it less appealing to future buyers.

Tip: Before buying, review rental trends in the building and the surrounding area. Look at historical data to determine if rental prices are dropping, and avoid buildings where rental income is on the decline.

10 Condos with a History of Significant Value Drops

A major red flag when purchasing a condo in Fort Lauderdale is a history of substantial value declines. Some buildings may have seen sharp price drops in the past due to factors like economic downturns, market fluctuations, or building-specific issues such as mismanagement or structural concerns.

Why It’s a Problem: Condos with a history of significant value decreases are often more susceptible to future market volatility, particularly during downturns. If a building has repeatedly lost value, it may indicate deeper issues, such as an undesirable location, oversupply in the area, or a lack of long-term appeal. Buying into such a property puts you at risk of losing equity in future market corrections, making it harder to sell at a profit—or even break even—when you’re ready to move on.

Tip: Investigate the condo’s value trends over the past 10-15 years, particularly during previous economic downturns, and avoid properties that have experienced steep declines. Instead, focus on condos with consistent or appreciating values to protect your investment from future market shifts. Our Condo Geeks software is especially helpful for this type of research, tracking historical performance to give you valuable insights.

Conclusion: The 10 Types of Fort Lauderdale Condos You Should Never Buy

Fort Lauderdale’s condo market is full of opportunities, but some properties carry hidden risks that could jeopardize your financial security and peace of mind. Be cautious of condos with excessive HOA fees, poor financial stability, ongoing lawsuits, frequent short-term rentals, deferred maintenance, insufficient hurricane protection, or an overabundance of amenities. By conducting thorough research into the building’s financial health, maintenance history, and policies, you can safeguard yourself from unexpected expenses and ensure your investment is a solid one.

We hope these 10 tips have helped you identify which types of condos to avoid. By being aware of these potential red flags, you’ll be able to make smarter, more informed choices when purchasing a condo. Avoiding these common pitfalls will not only help you secure a property that maintains its value but also one that adds to your quality of life. Choose wisely and invest in a condo that delivers lasting benefits, not unforeseen challenges.

Remember, buying a condo in Fort Lauderdale is about more than just the view or location—it’s about making a well-informed, smart decision that will pay off in the long term.

Schedule a Meeting with Elaine Tatum [Fort Lauderdale Expert] and David Siddons

If you want to know more about the nuances of the 10 Types of Fort Lauderdale Condos You Should Never Buy, contact me at 305.508.0899 or schedule a meeting via the calendar app below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS